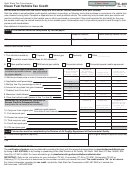

Arizona Form 313 - 2001 Alternative Fuel Vehicle (Afv) Credit Instructions Page 6

ADVERTISEMENT

F

o

r

m

3

1

3

F

o

r

m

3

1

3

Line 60 -

months, at least 50% during months 13 through 24, and

at least 50% during months 25 through 36.

If you elected to have the credit from the 2000 taxable year

•

If a bi-fuel vehicle that operates on CNG does not use CNG

refunded in 2 annual installments, enter the amount on line 59,

for at least 25% of the fuel used in the vehicle for the first

column (g). If you elected to have the credit from the 2000

12 months, at least 33 1/3% during months 13 through 24,

taxable year refunded in 3 annual installments, divide the

and at least 50% during months 25 through 36.

amount on line 59 column (g) by 2 and enter the result here.

•

The vehicle fails to comply with the emissions

Individuals also enter this amount on Form 140, page 1, line

inspection requirements for alternative fuel vehicles

37, or Form 140PY, page 1, line 39, or Form 140NR, page 1,

prescribed in Arizona Revised Statutes, Title 49,

line 37, or Form 140X, page 1, line 39.

Chapter 3, Article 5.

Corporations also enter this amount on Form 120, page 1,

If any of the above occurs, the department must calculate the

line 25, or Form 120A, page 1, line 17, or Form 120X, page

recapture as follows:

1, line 25.

•

If the date of the event that causes the recapture is within the

S corporations that are taking the credit also enter this

first full year after the vehicle is placed in service, 100%.

amount on Form 120S, page 1, line 21.

•

If the date of the event that causes the recapture is within the

Part XIII - Available Credit Carryover From

second full year after the vehicle is placed in service, 66 2/3%.

Taxable Years 1996, 1997, 1998, and 1999

•

If the date of the event that causes the recapture is within the

third full year after the vehicle is placed in service, 33 1/3%.

Lines 61 through 65 -

Complete lines 66 through 72 as instructed on the form.

Use lines 61 through 65 to figure your total available credit

carryover from taxable years 1996, 1997, 1998, and 1999.

Part

XV

-

Lessor/Lessee

Information

Complete lines 61 through 65 only if you claimed an AFV

Applicable to the Recapture

credit on a prior year return for 1996, 1997, 1998, and 1999,

and the credit was more than your tax.

Lines 73 through 80 -

In column (b), enter the credit originally computed for the

If a credit that is subject to recapture was shared by a lessor

taxable year entered in column (a). In column (c), enter the

and a lessee, then either the lessor or the lessee must

amount of the credit from that taxable year which you have

complete Part XV to let the other party know their share of

already used. Subtract the amount in column (c) from the

the credit recapture.

amount in column (b) and enter the difference in column (d).

Complete lines 73 through 80 as instructed on the form.

Add the amounts entered on lines 61 through 64 in column

(d). Enter the total on line 65, column (d).

Part XVI - S Corporation Shareholder

NOTE: You must also complete Form 300 (corporations) or

Information Applicable to the Recapture

Form 301 (individuals) if you are completing Part XIII of

Lines 81a through 81c -

Form 313.

If the credit was passed through from an S corporation to its

Corporations and S corporations that elect to take the credit

shareholders, the S corporation must provide each

also enter the amount on line 65, column (d), on Arizona

shareholder with information concerning the shareholder’s

Form 300, Part I, line 8.

pro rata share of the credit recapture. The S corporation

Individuals also enter the amount on line 65, column (d), on

must complete Part XVI, lines 81a through 81c separately for

Arizona Form 301, Part I, line 10.

each shareholder. The shareholder must complete Part XVIII

(lines 83 through 88).

NOTE Individuals Only: If you are married, and you and

your spouse file a separate return, you may each take only

Part XVII - Partnership Partner Information

one-half of the total credit that would otherwise be allowed

Applicable to the Recapture

on a joint return.

Lines 82a through 82c -

Part XIV – Credit Recapture Computation

If the credit was passed through from a partnership to its

Lines 66 through 72 -

partners, the partnership must provide each partner with

information concerning the partner’s pro rata share of the

The department is required to disallow the credit or to

credit recapture. The partnership must complete Part XVII,

recapture the credit if any of the following occur:

lines 82a through 82c separately for each partner.

The

•

The taxpayer transfers the vehicle to any person, other

partner must complete Part XVIII (lines 83 through 88).

than a member of the taxpayer’s immediate family or a

Part XVIII - All Taxpayers Subject to the

person who resides in the same household as the

taxpayer, within 36 months after the initial registration

Recapture

of the vehicle as an AFV. The recapture will not apply

Lines 83 through 88 -

if the vehicle is transferred because the vehicle is

demolished or if the taxpayer dies before the end of the

Complete lines 83 through 88 as instructed on the form.

36-month period.

Where Should I Mail My Return?

•

The vehicle is registered in Arizona for less than 36 months.

Attach this form to your Arizona income tax return, and mail

•

If a bi-fuel vehicle that operates on liquefied petroleum

your return to: Arizona Department of Revenue, PO Box 29206,

gas does not use liquefied petroleum gas for at least

Phoenix AZ 85038-9206. Do not mail your return to the

50% of the fuel used in the vehicle for the first 12

address indicated on the tax return.

6

6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6