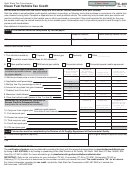

Arizona Form 313 - 2001 Alternative Fuel Vehicle (Afv) Credit Instructions Page 5

ADVERTISEMENT

F

o

r

m

3

1

3

F

o

r

m

3

1

3

If you checked box 54a, skip lines 56 and 57 and enter the

Part IX - S Corporation Election and

amount on line 55 on line 58.

Shareholder’s Share of Credit

If you checked box 54b or 54c, complete lines 56 and 57.

Line 47 - S Corporation Election

Line 56 -

All S corporations must complete line 47. The S corporation

Enter the tax from your 2001 income tax return, less any

must make an irrevocable election to either claim the credit

other tax credits that you are claiming. Do not include the

or pass the credit through to its shareholders. One of the

AFV credit from Form 313.

officers of the S corporation who is also a signatory to the

Line 57 -

Arizona Form 120S must sign this election.

Subtract line 56 from line 55.

Lines 48 through 50 -

Line 58 -

If the S corporation elects to pass the credit through to its

shareholders, it must also complete lines 48 through 50.

If the amount on line 56 is more than the credit being

claimed on Form 313, enter the amount from line 55 here.

An S corporation must complete the Form 313 through line

47. Then, complete lines 48 through 50 separately for each

If you checked the box on line 54a, enter the amount from

shareholder. Each shareholder may claim only a pro rata

line 55 here.

share of the credit based on the shareholder’s ownership

If you checked the box on line 54b, divide the amount on

interest in the S corporation. The S corporation must furnish

line 57 by 2 and add the result to the amount on line 56 and

each shareholder with a copy of the completed Form 313.

enter the total on line 58.

Each shareholder must complete lines 54 through 58.

If you checked box 54c, divide the amount on line 57 by 3

Part X - Partner’s Share of Credit

and add the result to the amount on line 56 and enter the total

on line 58.

Lines 51 through 53 -

NOTE: Do not complete Form 300 or Form 301 with Form

A partnership must complete the Form 313 through line 46.

313 unless you are completing Part XIII and/or Part XVIII

Then, complete lines 51 through 53 separately for each

of Form 313.

partner. Each partner may claim only a pro rata share of the

Individuals also enter this amount on Form 140, page 1, line

credit based on the partner’s ownership interest in the

37, or Form 140PY, page 1, line 39, or Form 140NR, page 1,

partnership. The partnership must furnish each partner with a

line 37, or Form 140X, page 1, line 39.

copy of the completed Form 313.

Each partner must complete lines 54 through 58.

NOTE Individuals Only: If you are married, and you and

your spouse file separate returns, you may each take only

Part XI - Refund Election for Current Year’s

one-half of the total credit that would otherwise be allowed

Credit - All Taxpayers Claiming the Credit

on a joint return.

Line 54 -

Corporations also enter this amount on Form 120, page 1,

line 25, or Form 120A, page 1, line 17, or Form 120X, page

If the allowable credit exceeds the income taxes due for the

1, line 25.

2001 taxable year, you must make an irrevocable election to

do one of the following:

S corporations that are taking the credit also enter this

amount on Form 120S, page 1, line 21.

•

Have the amount of credit not applied to taxes for the

2001 taxable year refunded in a lump sum.

Part XII - Refund Allocation For Taxpayers

•

Have the amount of credit not applied to taxes for the

That Elected to Have the 2000 Refund Paid

2001 taxable year refunded in two annual installments.

Out in Either 2 or 3 Annual Installments

•

Have the amount of credit not applied to taxes for the

Complete lines 59 and 60 only if you elected to claim the

2001 taxable year refunded in three annual installments.

amount of AFV credit refund from your 2000 return in either

If you elect to have the refund paid out in two or three annual

2 or 3 annual installments.

installments, no interest will be paid on those amounts.

Line 59 -

Check box 54a if you are electing a lump sum refund.

In column (b), check whether you elected either 2 or 3

Check box 54b if you are electing the refund be paid in two

annual installments. In column (c) enter the credit originally

annual installments.

computed for the 2000 taxable year. In column (d), enter the

Check box 54c if you are electing the refund be paid in three

amount of the 2000 taxable year credit that was applied to

annual installments.

your 2000 tax plus any amount of column (c) included in the

st

1

annual installment. In column (e), subtract the amount in

Line 55 -

column (d) from the amount in column (c). This is the

Individuals and corporations, including S corporations that

tentative amount available for refund installments.

elected to take the credit, enter the amount from Part VII,

Complete Parts XIV through XVIII, as applicable, before

line 37, or if a lessor, from part VIII, line 43 or if a lessee,

entering an amount in column (f). If required, in column (f),

from Part VIII, line 46. S corporation shareholders, enter the

enter the amount from Form 313, Part XVIII, line 88.

amount from Part IX, line 50. Partners of a partnership,

enter the amount from Part X, line 53.

Subtract the amount in column (f) from the amount in

column (e) and enter the difference in column (g).

If your 2001 tax is more than your credit shown on line 55, skip

lines 56 and 57 and enter the amount on line 55 on line 58.

5

5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6