Form 3150 - International Fuel Tax Agreement (Ifta) Return - Sample - 2006 Page 2

ADVERTISEMENT

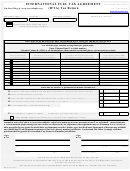

Form 3150 – page 2

State of Idaho

INTERNATIONAL FUEL TAX AGREEMENT (IFTA) RETURN

Licensee Name

License Number

Tax Period

↓

#

1=Gasoline 2=Diesel

3=Gasohol 4=Propane 5=LNG 6=CNG 7=Ethanol 8=Methanol 9=E-85 0=M-85 A=A55

#

Includes Biodiesel and Biodiesel Blends

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

JURIS-

FUEL

TAX

TOTAL

TOTAL

TAXABLE

TAX

NET

TAX

INTEREST

TOTAL

DICTION

TYPE

RATE

MILES

TAXABLE

GALLONS

PAID

TAXABLE

DUE/REFUND

DUE

DUE/REFUND

(8 ÷ AvgMPG

MILES

GALLONS

GALLONS

(11 X 6)

(12 + 13)

(See instructions)

from 3)

*

(9 - 10)

( Round to nearest whole mile and gallon )

( Enter negative numbers in brackets i.e. <50> )

TOTALS

SUBTOTAL OF COLUMNS 12, 13 and 14 (carry forward to page 1)

* Actual gallons bought in each jurisdiction (including Oregon) and placed into an IFTA qualified vehicle.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2