Form Fin 472 - Application For Refund Of Provincial Fuel Tax For Persons With Disabilities Page 2

ADVERTISEMENT

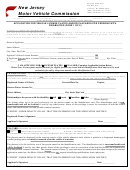

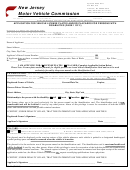

Step 5 Fuel Purchase Information

• Claims must be submitted within six years from the date you purchased the fuel.

• Each receipt must show that fuel was purchased, date purchased, number of litres purchased, and seller’s name and address.

Fuel Type

Area of Fuel Purchases

✔

✔

(

)

(

)

Select

the one

Select

the one area

Fuel Litres

Refund Claim Periods

type of fuel that you

where you purchased

Enter the

• Put your receipts in date order

purchased the most of

most of your fuel from

number of litres

• Total the number of litres for

purchased

Greater

Greater

each refund claim period, as

Other

for each refund

Vancouver

Victoria

Gas

Diesel Propane

Areas

indicated below

claim period

(see listing

(see listing

of BC

below)

below)

January 1, 2006 to December 31, 2006

12 months – refund maximum $500

Litres

January 1, 2005 to December 31, 2005

12 months – refund maximum $500

Litres

January 1, 2004 to December 31, 2004

12 months – refund maximum $500

Litres

January 1, 2003 to December 31, 2003

12 months – refund maximum $400

Litres

August 1, 2002 to December 31, 2002

5 months – refund maximum $170

Litres

August 1, 2001 to July 31, 2002

12 months – refund maximum $400

Litres

August 1, 2000 to July 31, 2001

12 months – refund maximum $400

Litres

August 1, 1999 to July 31, 2000

12 months – refund maximum $400

Litres

Greater Vancouver Area:

Anmore, Belcarra, Bowen Island, Burnaby, Coquitlam, Delta, Electoral Area “A”, Langley, Lions Bay, Maple Ridge, New Westminster,

North Vancouver, Pitt Meadows, Port Coquitlam, Port Moody, Richmond, Surrey, Vancouver, West Vancouver, White Rock

Greater Victoria Area:

Central Saanich, Colwood, District of Sooke, Esquimalt, Langford, Langford Electoral Area, Metchosin, North Saanich, Oak Bay,

Saanich, Sidney, Victoria, View Royal

Freedom of Information and Protection of Privacy Act (FIPPA)

The personal information requested is collected under the authority of and used for the purpose of administering the Motor Fuel Tax Act . Questions

about how the FIPPA applies to this personal information can be directed to the general inquiry line at 604 660-4524 in Vancouver, or toll-free at

1 877 388-4440 elsewhere in Canada, or in writing to Revenue Programs Division, Suite 800 - 360 West Georgia Street, Vancouver BC V6B 6B2.

REFUND ID

TOTPD

PERIOD

FOR OFFICE USE ONLY

VERIFIER'S INITIALS

DATE

APPROVER'S INITIALS

YYYY

MM

DD

FIN 472/WEB (Page 2) Rev. 2005 / 11 / 1

Clear Form

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4