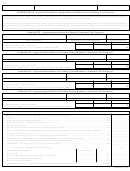

Form Fae 174 - Franchise And Excise Financial Institution Tax Return Page 3

ADVERTISEMENT

page 3

TAXABLE YEAR

TAXPAYER NAME

ACCOUNT NO./FEIN/SSN

SCHEDULE SF - Financial Institution Apportionment Schedule for Franchise Tax Purposes

The apportionment schedules below are to be used by financial institutions or unitary groups of financial institutions doing business within and without Tennessee

within the meaning of Tennessee statutes who have not elected to compute net worth on a consolidated basis.

In cases of unitary groups of financial institutions filing a combined return, a separate franchise tax apportionment ratio is to be computed for each member of

the unitary filing group and applied to the separate net worth of each member of the group to obtain the net worth apportioned to Tennessee. Such apportioned

net worth bases for each group member are then combined to obtain the franchise tax net worth base for the unitary filing group (see Schedule F1).

Schedule SF - Apportionment Ratio for Parent's Franchise Tax Purposes

Federal Employer (Tennessee) Identification Number

Corporation's Account Period

Name of Financial Institution

In Tennessee

Ratio

Everywhere

1. Receipts defined in T.C.A. §67-4-2118

%

Enter ratio on Schedule F1, Line 4 of Parent's computation schedule .................................

Schedule SF - Apportionment Ratio for Unitary Group Member's Franchise Tax Purposes

Federal Employer (Tennessee) Identification Number

Corporation's Account Period

Name of Financial Institution

In Tennessee

Everywhere

Ratio

1. Receipts defined in T.C.A. §67-4-2118

%

Enter ratio on Schedule F1, Line 4 of Unitary Group member's computation schedule .....

Schedule SF - Apportionment Ratio for Unitary Group Member's Franchise Tax Purposes

Federal Employer (Tennessee) Identification Number

Corporation's Account Period

Name of Financial Institution

In Tennessee

Ratio

Everywhere

1. Receipts defined in T.C.A. §67-4-2118

%

Enter ratio on Schedule F1, Line 4 of Unitary Group member's computation schedule .....

Schedule SF - Apportionment Ratio for Unitary Group Member's Franchise Tax Purposes

Federal Employer (Tennessee) Identification Number

Corporation's Account Period

Name of Financial Institution

In Tennessee

Everywhere

Ratio

1. Receipts defined in T.C.A. §67-4-2118

%

Enter ratio on Schedule F1, Line 4 of Unitary Group member's computation schedule .....

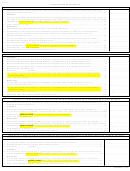

Schedule G - DETERMINATION OF REAL AND TANGIBLE PROPERTY

BOOK VALUE OF PROPERTY OWNED - Cost less accumulated depreciation

In Tennessee

1. Land ............................................................................................................................................................................................... (1) __________________

2. Buildings, leaseholds, and improvements ...................................................................................................................................... (2) __________________

3. Machinery, equipment, furniture, and fixtures .............................................................................................................................. (3) __________________

4. Automobiles and trucks ................................................................................................................................................................. (4) __________________

5. Prepaid supplies and other tangible personal property (Attach schedule) ................................................................................... (5) __________________

6. Share of partnership real and tangible property provided that the partnership does not file a return (Attach schedule) ............ (6) __________________

7. Inventories and work in progress .................................................................................................................................................. (7) __________________

a. Deduct exempt inventory in excess of $30 million (§67-4-2108(a)(6)(B)) ............................................................................. (7a) __________________

(

)

(

)

8. Deduct value of certified pollution control equipment (Include copy of certificate (§67-5-604)) .............................................. (8) __________________

(

)

9. Deduct exempt required capital investments (T.C.A. Section 67-4-2108(a)(6)(G)) ..................................................................... (9) __________________

10. SUBTOTALS - Add lines 1 through 7, less Line 7a through Line 9 ........................................................................................... (10) __________________

Rental Value of Property Used but not Owned

(A)

(B)

(C)

In Tennessee

Net Annual Rental Paid for:

x8

11. Real property

__________________________

(11) __________________

x3

12. Machinery & equipment used in manufacturing & processing

__________________________

(12) __________________

x2

13. Furniture, office machinery, and equipment

__________________________

(13) __________________

x1

14. Delivery or mobile equipment

__________________________

(14) __________________

15. TENNESSEE TOTAL - Add lines 10-14 (Enter total here and on Schedule A, Line 2) ............................................................ (15) __________________

INTERNET (11-06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8