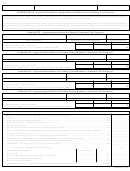

Form Fae 174 - Franchise And Excise Financial Institution Tax Return Page 8

ADVERTISEMENT

TENNESSEE DEPARTMENT OF REVENUE

LOSS CARRYOVER SCHEDULE

SCHEDULE U

(FORM FAE 174)

TAXABLE YEAR

ACCOUNT NO./FEIN/SSN

TAXPAYER NAME

NOTE: SCHEDULE U IS NOT REQUIRED TO BE FILED WITH THE RETURN. This schedule may be used as a

worksheet to compute the amount of net operating loss carryover.

IMPORTANT INFORMATION APPLICABLE TO LOSS CARRYOVER

1. Any net operating loss incurred for fiscal years ended on or after 3-15-82 and prior to 1-15-84 may

be carried forward seven (7) years as a net operating loss carryover.

2. Any net operating loss incurred for fiscal years ending on or after 1-15-84 may be carried for-

ward fifteen (15) years as a net operating loss carryover.

3. COMBINED RETURN - UNITARY GROUP OF FINANCIAL INSTITUTIONS:

Any net operating loss incurred by a member of the unitary group which has been apportioned to

Tennessee in a tax year ending prior to July 15, 1990, may be carried forward seven (7) years as

a net operating loss carryover by the unitary group. A net operating loss incurred by a unitary group

of financial institutions computed on a combined basis may be carried forward fifteen (15) years by

the unitary group.

Reference: Section 67-4-2006(c), Tennessee Code Annotated.

SCHEDULE U - SCHEDULE OF LOSS CARRYOVER

Period

For Original

Year

Ended

Return or

Used In

Loss Carryover

(mm/YY)

As Amended

Prior Year(s)

Expired

Available

1

_______________________________________________________________________________________________________

2

_______________________________________________________________________________________________________

3

_______________________________________________________________________________________________________

4

_______________________________________________________________________________________________________

5

_______________________________________________________________________________________________________

6

_______________________________________________________________________________________________________

7

_______________________________________________________________________________________________________

8

_______________________________________________________________________________________________________

9

_______________________________________________________________________________________________________

10

_______________________________________________________________________________________________________

11

_______________________________________________________________________________________________________

12

_______________________________________________________________________________________________________

13

_______________________________________________________________________________________________________

14

_______________________________________________________________________________________________________

15

_______________________________________________________________________________________________________

Total Amount (Transfer to Schedule J, Line 34) .......................................................................

INTERNET (11-06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8