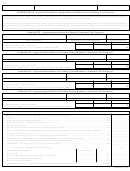

Form Fae 174 - Franchise And Excise Financial Institution Tax Return Page 5

ADVERTISEMENT

page 5

TAXPAYER NAME

ACCOUNT NO./FEIN/SSN

TAXABLE YEAR

Schedule J - COMPUTATION OF NET EARNINGS SUBJECT TO EXCISE TAX

1. Federal income or loss (Enter amount from Schedule J-1, J-2, J-3, or J-4) ..................................................................................... (1) __________________

2. Add expenses from transactions between members of the unitary group ....................................................................................... (2) __________________

3. Deduct dividends and receipts from transactions between members of the unitary group ............................................................. (3) __________________

4. Net income for unitary group financial institutions (Line 1 plus Line 2, less Line 3) ..................................................................... (4) __________________

ADDITIONS:

5. Any depreciation under the provisions of IRC Section 168 not permitted for excise tax purposes due to Tennessee

permanently decoupling from federal bonus depreciation and any expense/deprecation deducted as a result of "safe harbor"

lease elections. (attach schedule) ..................................................................................................................................................... (5) __________________

6. Any deduction for domestic production activities under the provisions of IRC Section 199 ........................................................ (6) __________________

7. Any gain on the sale of an asset sold within twelve months after the date of distribution to a nontaxable entity ......................... (7) __________________

8. Tennessee excise tax expense (to the extent reported for federal purposes) ................................................................................... (8) __________________

9. Gross premiums tax deducted in determining federal income and used as an excise tax credit ........................................................ (9) __________________

10. Interest income on obligations of states and their political subdivisions, less allowable amortization ......................................... (10) __________________

11. Depletion not based on actual recovery of cost ............................................................................................................................ (11) __________________

12. Contribution carryover from prior period(s) ................................................................................................................................. (12) __________________

13. Capital gains offset by capital loss carryover or carryback .......................................................................................................... (13) __________________

14. Excess fair market value over book value of property donated ..................................................................................................... (14) __________________

(15) ________________

15. Total additions - Add lines 5 through 14 .......................................................................................................................................

DEDUCTIONS:

16. Any depreciation under the provisions of IRC Section 168 permitted for excise tax purposes due to Tenneessee permanently

decoupling from federal bonus depreciation .................................................................................................................................. (16) __________________

17. Any excess gain (or loss) from the basis adjustment resulting from Tennessee permanently decoupling from federal bonus

depreciation ................................................................................................................................................................................... (17) __________________

18. Any loss on the sale of an asset sold within twelve months after the date of distribution to a nontaxable entity ....................... (18) __________________

19. Dividends received from corporations, at least 80% owned (attach schedule) ............................................................................. (19) __________________

20. Contributions in excess of amount allowed by federal government .............................................................................................. (20) __________________

21. Donations to Qualified Public School Support Groups and nonprofit organizations ................................................................... (21) __________________

22. Portion of current year’s capital loss not included in federal taxable income ................................................................................ (22) __________________

23. Any expense other than income taxes, not deducted in determining federal taxable income for which a credit against the

federal income tax is allowable ....................................................................................................................................................... (23) __________________

24. Any income included for federal tax purposes and any depreciation or other expense that could have been deducted for

“safe harbor” lease elections. (attach schedule) ............................................................................................................................. (24) __________________

25. Nonbusiness earnings - Schedule M, Line 8 .................................................................................................................................. (25) __________________

26. Intangible expense to an affiliated business entity (Intangible expense disclosure form MUST be completed to avoid the

adjustment provided in T.C.A. Section 67-4-2006(d)(3)) ............................................................................................................. (26) __________________

27. Intangible income from an affiliated business entity if the corresponding intangible expense has not been disclosed or has

(27) ________________

been disallowed ..............................................................................................................................................................................

28. Bad debts not deducted but allowed by I.R.C. 585 or 593 as it existed on 12-31-86 ................................................................... (28) __________________

(

)

29. Total deductions - Add lines 16 through 28 .................................................................................................................................. (29) __________________

COMPUTATION OF TAXABLE INCOME:

30. Total Business Income (Loss) - Add lines 4 and 15, less Line 29 (If loss, complete Schedule K) ............................................... (30) __________________

31. Apportionment Ratio (Schedule SE if applicable or 100%) ......................................................................................................... (31) __________________

%

32. Apportioned business income (Loss) (Line 30 multiplied by Line 31) ........................................................................................ (32) __________________

33. Add: Nonbusiness earnings directly allocated to Tennessee (From Schedule M, Line 9) ............................................................. (33) __________________

(

)

34. Deduct: Loss carryover from prior years (From Schedule U) ...................................................................................................... (34) __________________

35. Subject to excise tax (6.5%) (Line 32 plus Line 33, less Line 34) (enter here and on Schedule B, Line 4) .................................... (35) __________________

Schedule K - DETERMINATION OF LOSS CARRYOVER AVAILABLE -See Rule 1320-6-1-.21 of Departmental Rules and Regulations

1. Net loss from Schedule J, Line 30 ................................................................................................................................................. (1) __________________

ADD:

2. Amounts reported on Schedule J, lines 19 and 25 ......................................................................................................................... (2) __________________

3. Amounts reported on Schedule J-1, lines 6 and 7, and Schedule J-2, Line 9 ................................................................................. (3) __________________

4. Reduced loss - Add lines 1 through 3 (if net amount is positive, enter "0") ................................................................................. (4) __________________

%

5. Excise tax ratio (Schedule SE if applicable or 100%) .................................................................................................................... (5) __________________

6. Current year loss carryover available (Line 4 multiplied by Line 5) ............................................................................................. (6) __________________

Schedule L - FEDERAL INCOME REVISIONS

Year

1. Original Net Income

2. Net Income

3. Increase (Decrease)

4. Increase (Decrease)

on Federal Return

Corrected

in Net Income

Affecting Excise Tax

______________________________________________________________________________________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________________________________________________________________________

INTERNET (11-06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8