Cnic Naf 401(K) Savings Plan Termination Of Employment Form Page 2

ADVERTISEMENT

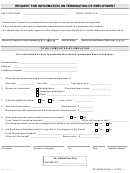

Termination of Employment Form

IRA/PLAN Rollover. I have read the Special Tax Notice and do not want Federal Tax of 20% withheld from my

'

payment. I elect to make direct rollover of the taxable portion of my payment to:

My new employer’s qualified plan

An IRA

'

'

Name of financial institution or new plan trustee to be listed as payee:

___________________________________________________________________________________

One-Sum Cash Payment or Rollover:

I have read The Special Tax Notice and:

Withholding does not apply as I have already rolled over the entire taxable amount.

Withhold the 20% mandatory federal tax withholding from the taxable portion of my payment

Withhold the 20% mandatory federal tax withholding from the taxable portion of my payment and withhold an

additional amount of $________________.

Leave My Account Balance in the Plan. (Only available if your current account balance exceeds the Plan’s minimum

cash-out amount of $5,000).

st

[Important Note: It is your responsibility to request a distribution by the required deadline: April 1

of the year following the

year you attain normal retirement age, attain age 70 ½, or retire after attaining age 70 ½, depending on Plan provisions and

other factors. More information can be provided upon your request.]

State Tax Withholding

Residents of states without state income tax (Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming)

or no withholding provisions (Arkansas, Hawaii, Idaho, Louisiana, Mississippi, New Hampshire, North Carolina,

Pennsylvania, Rhode Island, Tennessee, and West Virginia) must leave this section blank.

State income tax will be withheld from the taxable portion of a payment over the state’s minimum amount if you are a resident

of Iowa, Maine, Massachusetts, Oklahoma, Vermont or Virginia. You may elect an additional amount to be withheld in Box 1.

If you are a resident of California, Georgia or Oregon, state tax is withheld unless you check Box 2. Residents of other states

can elect no state tax withholding by checking Box 2, or can select the amount of state tax to be withheld in Box 1. Obtain

additional information by contacting your state’s Department of Revenue.

Box 1. I want $_______________________ (enter whole dollar amount) withheld from my payment for state income (or

as an additional amount for residents of IA, MA, ME, OK, VA, and VT).

Box 2. I do no want state income tax withheld from my payment.

SIGNATURES

I understand that there may be an administrative fee deducted from my account for processing and, if all

required items are not completed on this form, that processing may be delayed.

________________________________________________

_______________________

Participant Signature

Date

________________________________________________

________________________

Plan Administrator – HQ HR Signature

Date

Page 2 of 2

Revised 8/2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8