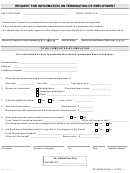

Cnic Naf 401(K) Savings Plan Termination Of Employment Form Page 7

ADVERTISEMENT

If you roll over your payment to a Roth IRA

You can roll over a payment from the Plan made before January 1, 2010 to a Roth IRA only if your modified

adjusted gross income is not more than $100,000 for the year the payment is made to you and, if married, you

file a joint return. These limitations do not apply to payments made to you from the Plan after 2009. If you wish

to roll over the payment to a Roth IRA, but you are not eligible to do a rollover to a Roth IRA until after 2009, you

can do a rollover to a traditional IRA and then, after 2009, elect to convert the traditional IRA into a Roth IRA.

If you roll over the payment to a Roth IRA, a special rule applies under which the amount of the payment rolled

over (reduced by any after-tax amounts) will be taxed. However, the 10% additional income tax on early

distributions will not apply (unless you take the amount rolled over out of the Roth IRA within 5 years, counting

from January 1 of the year of the rollover). For payments from the Plan during 2010 that are rolled over to a

Roth IRA, the taxable amount can be spread over a 2-year period starting in 2011.

If you roll over the payment to a Roth IRA, later payments from the Roth IRA that are qualified distributions will

not be taxed (including earnings after the rollover). A qualified distribution from a Roth IRA is a payment made

after you are age 59 1/2 (or after your death or disability, or as a qualified first-time homebuyer distribution of up

to $10,000) and after you have had a Roth IRA for at least 5 years. In applying this 5-year rule, you count from

January 1 of the year for which your first contribution was made to a Roth IRA. Payments from the Roth IRA that

are not qualified distributions will be taxed to the extent of earnings after the rollover, including the 10%

additional income tax on early distributions (unless an exception applies). You do not have to take required

minimum distributions from a Roth IRA during your lifetime. For more information, see IRS Publication 590,

Individual Retirement Arrangements (IRAs).

You cannot roll over a payment from the Plan to a designated Roth account in an employer plan.

If you are not a plan participant

Payments after death of the participant. If you receive a distribution after the participant's death that you do not

roll over, the distribution will generally be taxed in the same manner described elsewhere in this notice.

However, the 10% additional income tax on early distributions and the special rules for public safety officers do

not apply, and the special rule described under the section "If you were born on or before January 1, 1936"

applies only if the participant was born on or before January 1, 1936.

If you are a surviving spouse. If you receive a payment from the Plan as the surviving spouse of a

deceased participant, you have the same rollover options that the participant would have had, as

described elsewhere in this notice. In addition, if you choose to do a rollover to an IRA, you may treat the

IRA as your own or as an inherited IRA.

An IRA you treat as your own is treated like any other IRA of yours, so that payments made to you before

you are age 59 1/2 will be subject to the 10% additional income tax on early distributions (unless an

exception applies) and required minimum distributions from your IRA do not have to start until after you are

age 70 1/2.

If you treat the IRA as an inherited IRA, payments from the IRA will not be subject to the 10% additional

income tax on early distributions. However, if the participant had started taking required minimum

distributions, you will have to receive required minimum distributions from the inherited IRA. If the

participant had not started taking required minimum distributions from the Plan, you will not have to start

receiving required minimum distributions from the inherited IRA until the year the participant would have

been age 70 ½.

If you are a surviving beneficiary other than a spouse. If you receive a payment from the Plan because

of the participant's death and you are a designated beneficiary other than a surviving spouse, the only

rollover option you have is to do a direct rollover to an inherited IRA. Payments from the inherited IRA will

not be subject to the 10% additional income tax on early distributions. You will have to receive required

minimum distributions from the inherited IRA.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8