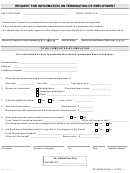

Cnic Naf 401(K) Savings Plan Termination Of Employment Form Page 6

ADVERTISEMENT

If you miss the 60-day rollover deadline

Generally, the 60-day rollover deadline cannot be extended. However, the IRS has the limited authority to waive

the deadline under certain extraordinary circumstances, such as when external events prevented you from

completing the rollover by the 60-day rollover deadline. To apply for a waiver, you must file a private letter ruling

request with the IRS. Private letter ruling requests require the payment of a nonrefundable user fee. For more

information, see IRS Publication 590, Individual Retirement Arrangements (IRAs).

If your payment includes employer stock that you do not roll over

If you do not do a rollover, you can apply a special rule to payments of employer stock (or other employer

securities) that are either attributable to after-tax contributions or paid in a lump sum after separation from

service (or after age 59 1/2, disability, or the participant's death). Under the special rule, the net unrealized

appreciation on the stock will not be taxed when distributed from the Plan and will be taxed at capital gain rates

when you sell the stock. Net unrealized appreciation is generally the increase in the value of employer stock

after it was acquired by the Plan. If you do a rollover for a payment that includes employer stock (for example,

by selling the stock and rolling over the proceeds within 60 days of the payment), the special rule relating to the

distributed employer stock will not apply to any subsequent payments from the IRA or employer plan. The Plan

administrator can tell you the amount of any net unrealized appreciation.

If you have an outstanding loan that is being offset

If you have an outstanding loan from the Plan, your Plan benefit may be offset by the amount of the loan,

typically when your employment ends. The loan offset amount is treated as a distribution to you at the time of

the offset and will be taxed (including the 10% additional income tax on early distributions, unless an exception

applies) unless you do a 60-day rollover in the amount of the loan offset to an IRA or employer plan.

If you were born on or before January 1, 1936

If you were born on or before January 1, 1936 and receive a lump sum distribution that you do not roll over,

special rules for calculating the amount of the tax on the payment might apply to you. For more information, see

IRS Publication 575, Pension and Annuity Income.

If your payment is from a governmental section 457(b) plan

If the Plan is a governmental section 457(b) plan, the same rules described elsewhere in this notice generally

apply, allowing you to roll over the payment to an IRA or an employer plan that accepts rollovers. One difference

is that, if you do not do a rollover, you will not have to pay the 10% additional income tax on early distributions

from the Plan even if you are under age 59 1/2 (unless the payment is from a separate account holding rollover

contributions that were made to the Plan from a tax-qualified plan, a section 403(b) plan, or an IRA). However, if

you do a rollover to an IRA or to an employer plan that is not a governmental section 457(b) plan, a later

distribution made before age 59 1/2 will be subject to the 10% additional income tax on early distributions

(unless an exception applies). Other differences are that you cannot do a rollover if the payment is due to an

"unforeseeable emergency" and the special rules under "If your payment includes employer stock that you do

not roll over" and "If you were born on or before January 1, 1936" do not apply.

If you are an eligible retired public safety officer and your pension payment is used to pay for health

coverage or qualified long-term care insurance

If the Plan is a governmental plan, you retired as a public safety officer, and your retirement was by reason of

disability or was after normal retirement age, you can exclude from your taxable income plan payments paid

directly as premiums to an accident or health plan (or a qualified long-term care insurance contract) that your

employer maintains for you, your spouse, or your dependents, up to a maximum of $3,000 annually. For this

purpose, a public safety officer is a law enforcement officer, firefighter, chaplain, or member of a rescue squad

or ambulance crew.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8