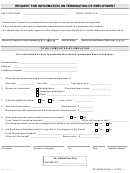

Cnic Naf 401(K) Savings Plan Termination Of Employment Form Page 4

ADVERTISEMENT

y Required minimum distributions after age 70 1/2 (or after death)

y Hardship distributions

y ESOP dividends

y Corrective distributions of contributions that exceed tax law limitations

y Loans treated as deemed distributions (for example, loans in default due to missed payments before your

employment ends)

y Cost of life insurance paid by the Plan

y Contributions made under special automatic enrollment rules that are withdrawn pursuant to your request

within 90 days of enrollment

y Amounts treated as distributed because of a prohibited allocation of S corporation stock under an ESOP

(also, there will generally be adverse tax consequences if you roll over a distribution of S corporation

stock to an IRA).

The Plan administrator or the payor can tell you what portion of a payment is eligible for rollover.

If I don't do a rollover, will I have to pay the 10% additional income tax on early distributions?

If you are under age 59 1/2, you will have to pay the 10% additional income tax on early distributions for any

payment from the Plan (including amounts withheld for income tax) that you do not roll over, unless one of the

exceptions listed below applies. This tax is in addition to the regular income tax on the payment not rolled over.

The 10% additional income tax does not apply to the following payments from the Plan:

y Payments made after you separate from service if you will be at least age 55 in the year of the separation

y Payments that start after you separate from service if paid at least annually in equal or close to equal

amounts over your life or life expectancy (or the lives or joint life expectancy of you and your

beneficiary)

y Payments from a governmental defined benefit pension plan made after you separate from service if you

are a public safety employee and you are at least age 50 in the year of the separation

y Payments made due to disability

y Payments after your death

y Payments of ESOP dividends

y Corrective distributions of contributions that exceed tax law limitations

y Cost of life insurance paid by the Plan

y Contributions made under special automatic enrollment rules that are withdrawn pursuant to your request

within 90 days of enrollment

y Payments made directly to the government to satisfy a federal tax levy

y Payments made under a qualified domestic relations order (QDRO)

y Payments up to the amount of your deductible medical expenses

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8