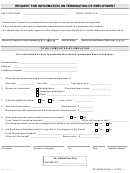

Cnic Naf 401(K) Savings Plan Termination Of Employment Form Page 3

ADVERTISEMENT

Special Tax Notice

For Payments Not From a Designated Roth Account

YOUR ROLLOVER OPTIONS

You are receiving this notice because all or a portion of a payment you are receiving from your retirement plan is

eligible to be rolled over to an IRA or an employer plan. This notice is intended to help you decide whether to do

such a rollover.

This notice describes the rollover rules that apply to payments from the Plan that are not from a designated Roth

account (a type of account with special tax rules in some employer plans). If you also receive a payment from a

designated Roth account in the Plan, you will be provided a different notice for that payment, and the Plan

administrator or the payor will tell you the amount that is being paid from each account.

Rules that apply to most payments from a plan are described in the "General Information About Rollovers"

section. Special rules that only apply in certain circumstances are described in the "Special Rules and Options"

section.

GENERAL INFORMATION ABOUT ROLLOVERS

How can a rollover affect my taxes?

You will be taxed on a payment from the Plan if you do not roll it over. If you are under age 59 1/2 and do not do

a rollover, you will also have to pay a 10% additional income tax on early distributions (unless an exception

applies). However, if you do a rollover, you will not have to pay tax until you receive payments later and the 10%

additional income tax will not apply if those payments are made after you are age 59 1/2 (or if an exception

applies).

Where may I roll over the payment?

You may roll over the payment to either an IRA (an individual retirement account or individual retirement

annuity) or an employer plan (a tax-qualified plan, section 403(b) plan, or governmental section 457(b) plan) that

will accept the rollover. The rules of the IRA or employer plan that holds the rollover will determine your

investment options, fees, and rights to payment from the IRA or employer plan (for example, no spousal consent

rules apply to IRAs and IRAs may not provide loans). Further, the amount rolled over will become subject to the

tax rules that apply to the IRA or employer plan.

How do I do a rollover?

There are two ways to do a rollover. You can do either a direct rollover or a 60-day rollover.

If you do a direct rollover, the Plan will make the payment directly to your IRA or an employer plan. You should

contact the IRA sponsor or the administrator of the employer plan for information on how to do a direct rollover.

If you do not do a direct rollover, you may still do a rollover by making a deposit into an IRA or eligible employer

plan that will accept it. You will have 60 days after you receive the payment to make the deposit. If you do not do

a direct rollover, the Plan is required to withhold 20% of the payment for federal income taxes (up to the amount

of cash and property received other than employer stock). This means that, in order to roll over the entire

payment in a 60-day rollover, you must use other funds to make up for the 20% withheld. If you do not roll over

the entire amount of the payment, the portion not rolled over will be taxed and will be subject to the 10%

additional income tax on early distributions if you are under age 59 1/2 (unless an exception applies).

How much may I roll over?

If you wish to do a rollover, you may roll over all or part of the amount eligible for rollover. Any payment from the

Plan is eligible for rollover, except:

y Certain payments spread over a period of at least 10 years or over your life or life expectancy (or the

lives or joint life expectancy of you and your beneficiary)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8