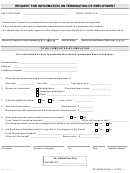

Cnic Naf 401(K) Savings Plan Termination Of Employment Form Page 8

ADVERTISEMENT

Payments under a qualified domestic relations order. If you are the spouse or former spouse of the participant

who receives a payment from the Plan under a qualified domestic relations order (QDRO), you generally have

the same options the participant would have (for example, you may roll over the payment to your own IRA or an

eligible employer plan that will accept it). Payments under the QDRO will not be subject to the 10% additional

income tax on early distributions.

If you are a nonresident alien

If you are a nonresident alien and you do not do a direct rollover to a U.S. IRA or U.S. employer plan, instead of

withholding 20%, the Plan is generally required to withhold 30% of the payment for federal income taxes. If the

amount withheld exceeds the amount of tax you owe (as may happen if you do a 60-day rollover), you may

request an income tax refund by filing Form 1040NR and attaching your Form 1042-S. See Form W-8BEN for

claiming that you are entitled to a reduced rate of withholding under an income tax treaty. For more information,

see also IRS Publication 519, U.S. Tax Guide for Aliens, and IRS Publication 515, Withholding of Tax on

Nonresident Aliens and Foreign Entities.

Other special rules

If a payment is one in a series of payments for less than 10 years, your choice whether to make a direct rollover

will apply to all later payments in the series (unless you make a different choice for later payments).

If your payments for the year are less than $200 (not including payments from a designated Roth account in the

Plan), the Plan is not required to allow you to do a direct rollover and is not required to withhold for federal

income taxes. However, you may do a 60-day rollover.

Unless you elect otherwise, if your plan’s cashout limit is greater than $1,000, a mandatory cashout of more

than $1,000 (not including payments from a designated Roth account in the Plan) will be directly rolled over to

an IRA chosen by the Plan administrator or the payor. A mandatory cashout is a payment from a plan to a

participant made before age 62 (or normal retirement age, if later) and without consent, where the participant's

benefit does not exceed the plan’s defined cashout limit (not in excess of $5,000 (may or may not include any

amounts held under the plan as a result of a prior rollover made to the plan)).

You may have special rollover rights if you recently served in the U.S. Armed Forces. For more information, see

IRS Publication 3, Armed Forces' Tax Guide.

FOR MORE INFORMATION

You may wish to consult with the Plan administrator or payor, or a professional tax advisor, before

taking a payment from the Plan. Also, you can find more detailed information on the federal tax

treatment of payments from employer plans in: IRS Publication 575, Pension and Annuity Income;

IRS Publication 590, Individual Retirement Arrangements (IRAs); and IRS Publication 571, Tax-

Sheltered Annuity Plans (403(b) Plans). These publications are available from a local IRS office, on

the web at , or by calling 1-800-TAX-FORM.

* * *

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8