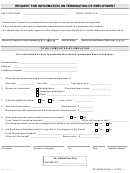

Cnic Naf 401(K) Savings Plan Termination Of Employment Form Page 5

ADVERTISEMENT

y Certain payments made while you are on active duty if you were a member of a reserve component

called to duty after September 11, 2001 for more than 179 days

y Payments of certain automatic enrollment contributions requested to be withdrawn within 90 days of the

first contribution.

If I do a rollover to an IRA, will the 10% additional income tax apply to early distributions from the IRA?

If you receive a payment from an IRA when you are under age 59 1/2, you will have to pay the 10% additional

income tax on early distributions from the IRA, unless an exception applies. In general, the exceptions to the

10% additional income tax for early distributions from an IRA are the same as the exceptions listed above for

early distributions from a plan. However, there are a few differences for payments from an IRA, including:

y There is no exception for payments after separation from service that are made after age 55.

y The exception for qualified domestic relations orders (QDROs) does not apply (although a special rule

applies under which, as part of a divorce or separation agreement, a tax-free transfer may be made

directly to an IRA of a spouse or former spouse).

y The exception for payments made at least annually in equal or close to equal amounts over a specified

period applies without regard to whether you have had a separation from service.

y There are additional exceptions for (1) payments for qualified higher education expenses, (2) payments

up to $10,000 used in a qualified first-time home purchase, and (3) payments after you have received

unemployment compensation for 12 consecutive weeks (or would have been eligible to receive

unemployment compensation but for self-employed status).

Will I owe State income taxes?

This notice does not describe any State or local income tax rules (including withholding rules).

SPECIAL RULES AND OPTIONS

If your payment includes after-tax contributions

After-tax contributions included in a payment are not taxed. If a payment is only part of your benefit, an allocable

portion of your after-tax contributions is generally included in the payment. If you have pre-1987 after-tax

contributions maintained in a separate account, a special rule may apply to determine whether the after-tax

contributions are included in a payment.

You may roll over to an IRA a payment that includes after-tax contributions through either a direct rollover or a

60-day rollover. You must keep track of the aggregate amount of the after-tax contributions in all of your IRAs (in

order to determine your taxable income for later payments from the IRAs). If you do a direct rollover of only a

portion of the amount paid from the Plan and a portion is paid to you, you can decide whether you want to

rollover your after tax portion or have it paid directly to you as a cash distribution. If you do a 60-day rollover to

an IRA of only a portion of the payment made to you, the after-tax contributions are treated as rolled over last.

For example, assume you are receiving a complete distribution of your benefit which totals $12,000, of which

$2,000 is after-tax contributions. In this case, if you roll over $10,000 to an IRA in a 60-day rollover, no amount

is taxable because the $2,000 amount not rolled over is treated as being after-tax contributions.

You may roll over to an employer plan all of a payment that includes after-tax contributions, but only through a

direct rollover (and only if the receiving plan separately accounts for after-tax contributions and is not a

governmental section 457(b) plan). You can do a 60-day rollover to an employer plan of part of a payment that

includes after-tax contributions, but only up to the amount of the payment that would be taxable if not rolled

over.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8