Draft Excerpts From Form 1040 Family Of Instructions (Including Schedule Instructions) Page 22

ADVERTISEMENT

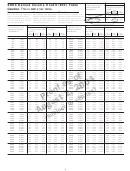

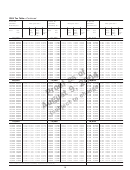

2004 Tax Computation Worksheet—Line 43

See the instructions for line 43 on page 33 to see if you can use the worksheet below to figure your tax.

!

CAUTION

Section A—Use if your filing status is Single. Complete the row below that applies to you.

(a) If the amount on Form

(b) Enter the amount

(c) Multiplication (d) Multiply column

(e) Subtraction

Your tax. Subtract

1040, line 42 is:

from Form 1040,

amount

(b) by column (c)

amount

column (e) from

line 42

column (d). Enter the

result here and on

Form 1040, line 43

At least $100,000 but not over

× 28% (.28)

$146,750

$

$

$ 5,373.00

$

Over $146,750 but not over

× 33% (.33)

$319,100

$

$

$ 12,710.50

$

× 35% (.35)

Over $319,100

$

$

$ 19,092.50

$

Section B —Use if your filing status is Married filing jointly or qualifying widow(er). Complete the row below that applies to

you.

(a) If the amount on Form

(b) Enter the amount

(c) Multiplication (d) Multiply column

(e) Subtraction Your tax. Subtract

1040, line 42 is:

from Form 1040,

amount

(b) by column (c)

amount

column (e) from

line 42

column (d). Enter the

result here and on

Form 1040, line 43

At least $100,000 but not over

× 25% (.25)

$117,250

$

$

$ 6,525.00

$

Over $117,250 but not over

× 28% (.28)

$178,650

$

$

$ 10,042.50

$

Over $178,650 but not over

× 33% (.33)

$319,100

$

$

$ 18,975.00

$

× 35% (.35)

Over $319,100

$

$

$ 25,357.00

$

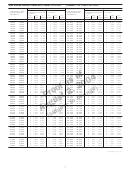

Section C—Use if your filing status is Married filing separately. Complete the row below that applies to you.

(a) If the amount on Form

(b) Enter the amount

(c) Multiplication (d) Multiply column

(e) Subtraction Your tax. Subtract

1040, line 42 is:

from Form 1040,

amount

(b) by column (c)

amount

column (e) from

line 42

column (d). Enter the

result here and on

Form 1040, line 43

At least $100,000 but not over

× 33% (.33)

$159,550

$

$

$ 9,487.50

$

× 35% (.35)

Over $159,550

$

$

$ 12,678.50

$

Section D—Use if your filing status is Head of household. Complete the row below that applies to you.

(a) If the amount on Form

(b) Enter the amount

(c) Multiplication (d) Multiply column

(e) Subtraction Your tax. Subtract

1040, line 42 is:

from Form 1040,

amount

(b) by column (c)

amount

column (e) from

line 42

column (d). Enter the

result here and on

Form 1040, line 43

At least $100,000 but not over

× 25% (.25)

$100,500

$

$

$ 4,400.00

$

Over $100,500 but not over

× 28% (.28)

$162,700

$

$

$ 7,415.00

$

Over $162,700 but not over

× 33% (.33)

$319,100

$

$

$ 15,550.00

$

× 35% (.35)

Over $319,100

$

$

$ 21,932.00

$

22

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25