Draft Excerpts From Form 1040 Family Of Instructions (Including Schedule Instructions) Page 9

ADVERTISEMENT

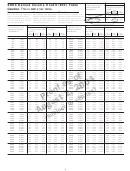

2004 Earned Income Credit (EIC) Table—Continued

(Caution. This is not a tax table.)

And your filing status is—

And your filing status is—

Single, head of household,

Married filing jointly and

Single, head of household,

Married filing jointly and

If the amount you are

If the amount you are

or qualifying widow(er) and

you have—

or qualifying widow(er) and

you have—

looking up from the

looking up from the

you have—

you have—

worksheet is—

worksheet is—

No

One

Two

No

One

Two

No

One

Two

No

One

Two

children

child

children

children

child

children

children

child

children

children

child

children

Your credit is—

Your credit is—

Your credit is—

Your credit is—

At least

But less than

At least

But less than

31,000

31,050

33,500

33,550

0

0

723

0

50

934

0

0

196

0

0

407

31,050

31,100

33,550

33,600

0

0

712

0

42

923

0

0

186

0

0

397

31,100

31,150

33,600

33,650

0

0

702

0

34

912

0

0

175

0

0

386

31,150

31,200

33,650

33,700

0

0

691

0

26

902

0

0

165

0

0

375

31,200

31,250

33,700

33,750

0

0

681

0

18

891

0

0

154

0

0

365

31,250

31,300

33,750

33,800

0

0

670

0

10

881

0

0

144

0

0

354

31,300

31,350

33,800

33,850

0

0

660

0

870

0

0

133

0

0

344

**

31,350

31,400

33,850

33,900

0

0

649

0

0

860

0

0

123

0

0

333

31,400

31,450

33,900

33,950

0

0

639

0

0

849

0

0

112

0

0

323

31,450

31,500

33,950

34,000

0

0

628

0

0

839

0

0

102

0

0

312

31,500

31,550

34,000

34,050

0

0

618

0

0

828

0

0

91

0

0

302

31,550

31,600

34,050

34,100

0

0

607

0

0

818

0

0

81

0

0

291

31,600

31,650

34,100

34,150

0

0

597

0

0

807

0

0

70

0

0

281

31,650

31,700

34,150

34,200

0

0

586

0

0

797

0

0

60

0

0

270

31,700

31,750

34,200

34,250

0

0

576

0

0

786

0

0

49

0

0

260

31,750

31,800

34,250

34,300

0

0

565

0

0

776

0

0

39

0

0

249

31,800

31,850

34,300

34,350

0

0

554

0

0

765

0

0

28

0

0

239

31,850

31,900

34,350

34,400

0

0

544

0

0

755

0

0

17

0

0

228

31,900

31,950

34,400

34,450

0

0

533

0

0

744

0

0

7

0

0

218

31,950

32,000

34,450

34,500

0

0

523

0

0

733

0

0

0

0

207

***

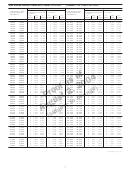

32,000

32,050

34,500

34,550

0

0

512

0

0

723

0

0

0

0

0

196

32,050

32,100

34,550

34,600

0

0

502

0

0

712

0

0

0

0

0

186

32,100

32,150

34,600

34,650

0

0

491

0

0

702

0

0

0

0

0

175

32,150

32,200

34,650

34,700

0

0

481

0

0

691

0

0

0

0

0

165

32,200

32,250

34,700

34,750

0

0

470

0

0

681

0

0

0

0

0

154

32,250

32,300

34,750

34,800

0

0

460

0

0

670

0

0

0

0

0

144

32,300

32,350

34,800

34,850

0

0

449

0

0

660

0

0

0

0

0

133

32,350

32,400

34,850

34,900

0

0

439

0

0

649

0

0

0

0

0

123

32,400

32,450

34,900

34,950

0

0

428

0

0

639

0

0

0

0

0

112

32,450

32,500

34,950

35,000

0

0

418

0

0

628

0

0

0

0

0

102

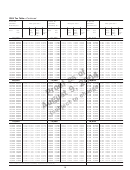

35,000

35,050

32,500

32,550

0

0

0

0

0

91

0

0

407

0

0

618

35,050

35,100

32,550

32,600

0

0

0

0

0

81

0

0

397

0

0

607

35,100

35,150

32,600

32,650

0

0

0

0

0

70

0

0

386

0

0

597

35,150

35,200

32,650

32,700

0

0

0

0

0

60

0

0

375

0

0

586

35,200

35,250

32,700

32,750

0

0

0

0

0

49

0

0

365

0

0

576

35,250

35,300

32,750

32,800

0

0

0

0

0

39

0

0

354

0

0

565

35,300

35,350

32,800

32,850

0

0

0

0

0

28

0

0

344

0

0

554

35,350

35,400

32,850

32,900

0

0

0

0

0

17

0

0

333

0

0

544

35,400

35,450

32,900

32,950

0

0

0

0

0

7

0

0

323

0

0

533

35,450

35,458

32,950

33,000

0

0

0

0

0

1

0

0

312

0

0

523

33,000

33,050

35,458 or more

0

0

302

0

0

512

0

0

0

0

0

0

33,050

33,100

0

0

291

0

0

502

33,100

33,150

0

0

281

0

0

491

33,150

33,200

0

0

270

0

0

481

33,200

33,250

0

0

260

0

0

470

33,250

33,300

0

0

249

0

0

460

33,300

33,350

0

0

239

0

0

449

33,350

33,400

0

0

228

0

0

439

33,400

33,450

0

0

218

0

0

428

33,450

33,500

0

0

207

0

0

418

**If the amount you are looking up from the worksheet is at least $30,300 ($31,300 if married filing jointly) but less than $30,338 ($31,338 if married filing jointly), your

credit is $3. Otherwise, you cannot take the credit.

***If the amount you are looking up from the worksheet is at least $34,450 but less than $34,458, your credit is $1. Otherwise, you cannot take the credit.

9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25