Sales And Use Tax Information For Motor Vehicle Sales, Leases, And Repairs - State Of Wisconsin Page 15

ADVERTISEMENT

Sales and Use Tax Information for Motor Vehicle Sales, Leases, and Repairs

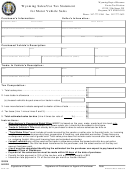

ing section “E” of Form MV11 (nondealers by com-

J. Volunteer Fire Departments

pleting section “E” of Form MV-1).

Sales, leases, and rentals of fire trucks, ambulances,

This exemption applies to motor vehicles sold to non-

and rescue vehicles and related equipment, and parts

resident corporations. An example of a nonresident

and supplies therefor, to volunteer fire departments

corporation is a corporation that is incorporated out-

are exempt from Wisconsin sales or use tax.

side Wisconsin that does not have a place of business

in Wisconsin.

K. Native Americans

Sales to Native Americans who live on a Native

If this exemption does not apply, a credit may be al-

American reservation, by retailers located either on or

lowed in the state of residence for the Wisconsin sales

off a Native American reservation, are not subject to

or use tax paid. The customer should contact the resi-

Wisconsin sales or use tax, if delivery of the motor

dent state for more information.

vehicle occurs on the Native American’s tribal reser-

Caution: This exemption applies only to truck bodies

vation. (Caution: If a retailer knows that the property

and motor vehicles as defined in sec. Tax 11.83(1),

or service is intended for consumption, use, or storage

Wis. Adm. Code, and does not include boats, snow-

in Wisconsin, but off the Native American’s tribal

mobiles, all-terrain vehicles, trailers, or the separate

reservation, the retailer is required to collect sales or

sale of a “slide-in” camper.

use tax on such property or service.)

G. Purchases Prior to Becoming Wisconsin Resident

In order to show that the sale is exempt, the dealer

should obtain an exemption certificate (Form S-207)

An aircraft, motor vehicle, boat, snowmobile, mobile

signed by the Native American stating that the Native

home, trailer, semitrailer, or all-terrain vehicle pur-

American took possession of the motor vehicle on the

chased outside Wisconsin for personal use by a

reservation of which he or she is an enrolled member.

nonresident of Wisconsin 90 days or more before

bringing it into Wisconsin, in connection with a

For more information about taxation of Native

change of domicile to Wisconsin, is exempt from

Americans, obtain the tax release titled “Taxation of

Wisconsin use tax.

Indians” published in Wisconsin Tax Bulletin 69 (Oc-

tober 1990).

H. Delivery Outside Wisconsin

L. Beneficiaries

Sales of any type of motor vehicle, trailer, car caddie,

slide-in camper, etc., are not subject to Wisconsin

A motor vehicle received as a bequest or inheritance

sales or use tax if delivery is physically made outside

from an estate is not subject to Wisconsin sales or use

of Wisconsin to a nonresident customer or the cus-

tax. However, the sale of a motor vehicle by a per-

tomer’s agent. The item is also exempt if delivery is

sonal representative of an estate is taxable.

made by common carrier under a bill of lading to a

M. Repossessions

location outside of Wisconsin, regardless of any f.o.b.

point or whether the freight is paid in advance or is

Repossessions of motor vehicles by a motor vehicle

made freight charges collect.

dealer, when the only consideration is cancellation of

the customer’s obligation to pay for the motor vehi-

I. Driver’s Education Vehicles

cle, are not subject to tax. However, the sale of the

The loan of a motor vehicle by a motor vehicle dealer

repossessed motor vehicle is subject to Wisconsin

to any school or school district for a driver training

sales or use tax, unless an exemption applies.

educational program conducted by the school or

N. Federal Banks and Credit Unions

school district is not subject to Wisconsin sales or use

tax.

Sales, leases, and rentals to Federal Reserve Banks

and federally chartered credit unions are not subject

to tax. However, sales, leases, and rentals to state

13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49