Sales And Use Tax Information For Motor Vehicle Sales, Leases, And Repairs - State Of Wisconsin Page 27

ADVERTISEMENT

Sales and Use Tax Information for Motor Vehicle Sales, Leases, and Repairs

constructed as to carry any load thereon either

3% rental vehicle fee if Company A is an es-

independently or any part of the weight of the

tablishment primarily engaged in the short-

vehicle or load so drawn.

term rental of vehicles without drivers.

•

•

Truck tractors – Motor vehicles designed and

Rentals as a service or repair replacement ve-

use primarily for the drawing other vehicles

hicle

and not so constructed as to carry a load other

Example: Individual A takes his automobile

than a part of the weight of the vehicle and

to Company B for repair. For a fee of $20 per

load so drawn.

day, Company B provides Individual A with

•

an automobile to use while his automobile is

Semitrailers – Vehicles of the trailer type so

being repaired. Individual A picks up the

designed and used in conjunction with a mo-

automobile in Wisconsin and uses it for five

tor vehicle that some part of its own weight

days.

and that of its own load rests upon or is car-

ried by another vehicle, but do not include

The charge by Company B to Individual A for

mobile homes. A vehicle used with a redi-mix

the use of the automobile is not subject to the

motor truck to spread the load is a semitrailer.

3% rental vehicle fee. Company B should

•

obtain

an

exemption

certificate

(Form

Trailers – Vehicles without motive power de-

RV-207) from the customer.

signed for carrying property or passengers

wholly on its own structure and for being

•

Rentals to the federal government

drawn by a motor vehicle, but do not include

mobile homes.

•

Rentals to organizations under sec. 77.54(9a),

•

Wis. Stats., including a Wisconsin state

Motor buses – Motor vehicles designed pri-

agency, county, city, village, town, public

marily for the transportation of persons rather

school, or school district and nonprofit or-

than property and having a passenger-

ganizations that hold a Certificate of Exempt

carrying capacity of 16 or more persons, in-

Status (CES) issued by the Wisconsin De-

cluding the operator. Passenger-carrying

partment of Revenue

capacity shall be determined by dividing by

20 the total seating space measured in inches.

•

Rentals by any public or private elementary

or secondary school exempt from Wisconsin

2. Exemptions

income or franchise taxes, including school

The following exemptions apply to the rental ve-

districts

hicle fee:

Note: Exemptions, other than those listed above,

•

that apply for Wisconsin sales or use tax purposes

Rerentals

(e.g., common or contract carriage) do not apply

for the rental vehicle fee.

Example: Company A leases an automobile

in Wisconsin from Company B for 30 days or

3. Returns

less. Company A will use the automobile

solely to lease to Individual C in Wisconsin.

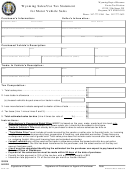

The rental vehicle fee is reported on the Wiscon-

sin Rental Vehicle Fee Return (Form RV-012)

The charge by Company B to Company A for

Note: Do not report the rental vehicle fee on a

the lease of the automobile is not subject to

Wisconsin sales and use tax return, Form ST-12.

the 3% rental vehicle fee because it is for

rerental. Company A should provide Com-

pany B with a properly completed resale

certificate (Form S-205). The charge by

Company A to Individual C is subject to the

25

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49