Sales And Use Tax Information For Motor Vehicle Sales, Leases, And Repairs - State Of Wisconsin Page 47

ADVERTISEMENT

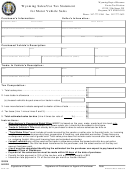

WISCONSIN RESALE CERTIFICATE

Instructions: This certificate should be completed by the purchaser and given to the seller for retention as part of the seller's

records.

Single Purchase

Continuous

(Remains in force until canceled by the purchaser or the department.)

I HEREBY CERTIFY: That I hold Seller’s Permit No.

* issued pursuant to the Wisconsin

sales and use tax law, and that I am engaged in the business of selling, leasing, or renting:

(DESCRIPTION OF PROPERTY OR SERVICE)

That the tangible personal property or taxable service described herein which I shall purchase from:

(SUPPLIER’S NAME)

will be resold, leased, or rented by me; provided, however, that in the event any such property is used for any purpose other

than retention, demonstration, or display while holding it for sale, lease, or rental in the regular course of business, I understand

that I am required by the sales and use tax law to report and pay the tax measured by the purchase price of such property.

(Description of kind of property purchased must be provided for the certificate to be valid. For a “Single Purchase,” itemize the property

purchased; for a “Continuous” certificate, give general description of the kind of property to be purchased for resale, lease, or rental in the regular

course of the purchaser’s business.)

A “Continuous” certificate giving a general description of the kind of property purchased is good until revoked in writing. If a

purchaser, who has given a “Continuous” certificate, asserts that he is buying for resale property of a kind not normally resold

in his business, the seller should ask for a “Single Purchase” resale certificate listing the specific property.

PURCHASER’S BUSINESS NAME AND ADDRESS

TYPE OF BUSINESS ACTIVITY (E.G. MAIL ORDER, TAVERN, ETC.)

PURCHASER’S SIGNATURE

TITLE

DATE

* Certain purchasers may use this certificate even though they do not hold a Wisconsin Seller’s Permit: (a) A wholesaler who sells only to other

sellers for resale may insert “Wholesale Only” in the space for the Seller’s Permit number; or (b) A person registered as a seller in another

state who makes no retail sales in Wisconsin may insert the name of the state in which registered and that state’s Seller’s Permit number.

However, a supplier may not accept a certificate from a business not holding a Wisconsin Seller’s Permit, if the sale involves the supplier’s

delivery of goods to a consumer in Wisconsin.

IMPORTANT: Sellers claiming exemptions by reason of “Sales for Resale” are required to retain resale certificates in

support of such exemptions. See back of this form for further information regarding the use of this certificate.

QUESTIONS: If either the purchaser or the seller has any questions regarding the completion or use of this resale

certificate, please call (608) 266-2776 or write to the Wisconsin Department of Revenue, P.O. Box 8902,

Madison, WI 53708-8902.

This Form May Be Reproduced

)

Wisconsin Department of Revenue

S-205 (R. 4-92

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49