Sales And Use Tax Information For Motor Vehicle Sales, Leases, And Repairs - State Of Wisconsin Page 29

ADVERTISEMENT

Sales and Use Tax Information for Motor Vehicle Sales, Leases, and Repairs

•

services are exempt from sales and use tax, such per-

Rentals to organizations under sec. 77.54(9a),

son is required to keep a record of the name and

Wis. Stats., including a Wisconsin state

address of the person to whom the exempt sale was

agency, county, city, village, town, public

made, the date of sale, the article sold, the amount of

school, or school district and nonprofit or-

exemption, the reason that the sale was exempt from

ganizations that hold a Certificate of Exempt

tax, and a signature of the purchaser. The department

Status (CES) issued by the Wisconsin De-

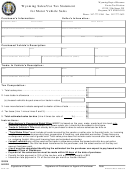

has preprinted exemption certificates available (e.g.,

partment of Revenue

Form S-205, Form S-207). However other documents

•

such as purchase orders, sales documents, etc., may

Rentals by any public or private elementary

be used in lieu of the department prepared forms,

or secondary school exempt from Wisconsin

provided they contain the required information dis-

income or franchise taxes, including school

cussed above.

districts

The reason for keeping such records is that the sales

3. Returns

and use tax law provides that all gross receipts are

The limousine fee is reported on the Wisconsin

taxable until the contrary is established. The seller has

Rental Vehicle Fee Return (Form RV-012). Note:

the burden of proving that a sale of tangible personal

Do not report the limousine fee on a Wisconsin

property or taxable services is exempt, unless the

seller takes in good faith a certificate (or other infor-

sales and use tax return, Form ST-12.

mation as described in 3. and 4. below) in an

approved form from the purchaser which indicates

X. RECORD KEEPING

that the property or service being purchased is for re-

sale or is otherwise exempt.

A. General

Four common reasons that sales of tangible personal

Every person required to have a seller’s permit must

property or taxable services may be exempt are:

keep adequate records of business transactions to en-

able that person, as well as the Department of

1. The customer furnishes the seller a resale certifi-

Revenue, to determine the correct amount of tax for

cate which the seller accepts in good faith. The

which the person is liable. The law requires that all

resale certificate is given to the seller because the

persons must report their gross receipts by the accrual

customer declares that he or she is going to resell

accounting method, unless the Department of Reve-

the item.

nue determines an undue hardship would result. In

such situations, the cash basis is permitted.

2. The use to be made of the item purchased (for ex-

ample, the item is going to be used exclusively in

Each permittee is required to keep a complete and ac-

common or contract carriage and is, therefore,

curate record of beginning and ending inventories,

exempt). The seller should obtain a completed

purchases, sales, cancelled checks, receipts, invoices,

exemption certificate from the customer.

bills of lading, and all other pertinent documents and

books of accounting pertaining to the business. Re-

3. The nature of the organization the customer rep-

tailers engaged in business in a county which has

resents (such as churches, schools, Wisconsin

adopted the county tax or a county that has the sta-

municipalities, federal government). Sales to the

dium tax shall keep records showing the county and

federal government and Wisconsin government,

stadium sales and use taxes due in that county or dis-

municipalities, and public schools may be sup-

trict. Any person who fails or refuses to keep

ported by a) a government exemption certificate

adequate records may be subject to penalties.

(Form S-209), or b) a copy of the purchase order,

which should be retained as part of the seller’s re-

B. Exemption Certificates and Exemption Claims

cords, or by recording the governmental unit’s

Certificate of Exempt Status on the invoice.

If a person (such as a motor vehicle dealer, lessor, ga-

rage, service station, etc.) claims that part or all of his

or her sales of tangible personal property or taxable

27

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49