Application For Sales Tax/use Tax Form - 1999

ADVERTISEMENT

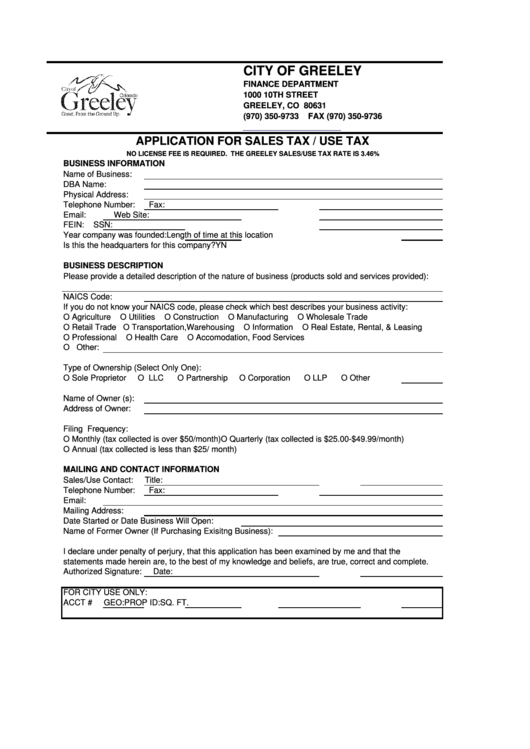

CITY OF GREELEY

FINANCE DEPARTMENT

1000 10TH STREET

GREELEY, CO 80631

(970) 350-9733

FAX (970) 350-9736

APPLICATION FOR SALES TAX / USE TAX

NO LICENSE FEE IS REQUIRED. THE GREELEY SALES/USE TAX RATE IS 3.46%

BUSINESS INFORMATION

Name of Business:

DBA Name:

Physical Address:

Telephone Number:

Fax:

Email:

Web Site:

FEIN:

SSN:

Year company was founded:

Length of time at this location

Is this the headquarters for this company?

Y

N

BUSINESS DESCRIPTION

Please provide a detailed description of the nature of business (products sold and services provided):

NAICS Code:

If you do not know your NAICS code, please check which best describes your business activity:

O Agriculture

O Utilities

O Construction

O Manufacturing

O Wholesale Trade

O Retail Trade O Transportation,Warehousing

O Information

O Real Estate, Rental, & Leasing

O Professional

O Health Care

O Accomodation, Food Services

O Other:

Type of Ownership (Select Only One):

O Sole Proprietor

O LLC

O Partnership

O Corporation

O LLP

O Other

Name of Owner (s):

Address of Owner:

Filing Frequency:

O Monthly (tax collected is over $50/month)

O Quarterly (tax collected is $25.00-$49.99/month)

O Annual (tax collected is less than $25/ month)

MAILING AND CONTACT INFORMATION

Sales/Use Contact:

Title:

Telephone Number:

Fax:

Email:

Mailing Address:

Date Started or Date Business Will Open:

Name of Former Owner (If Purchasing Exisitng Business):

I declare under penalty of perjury, that this application has been examined by me and that the

statements made herein are, to the best of my knowledge and beliefs, are true, correct and complete.

Authorized Signature:

Date:

FOR CITY USE ONLY:

ACCT #

GEO:

PROP ID:

SQ. FT.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4