Application For Sales Tax/use Tax Form - 1999 Page 2

ADVERTISEMENT

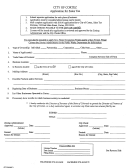

CITY OF GREELEY

FINANCE DEPARTMENT

1000 10TH STREET

GREELEY, CO 80631

(970) 350-9733

FAX (970) 350-9736

APPLICATION FOR SALES TAX / USE TAX

INSTRUCTIONS

GENERAL INFORMATION:

* If the business or home occupation has a physical location within the City limits of Greeley,

a Sales/Use Tax License/Zoning Review/Occupancy Certificate check-off list must be

completed and signed by the Community Development and Building Inspection departments.

These departments are located at 1100 10th Street, Greeley, CO 80631. There are no charges

for these services and there is no sales/use tax license fee required.

* If the business is a City of Greeley sewer user, the Commercial Sewer User Classification

Questionnaire must be completed.

* Return the completed and signed application, the completed and signed

check-off list (if applicable) and sewer questionnaire (if applicable) to the following address:

City of Greeley, Finance Department, 1000 10th Street, Greeley, CO 80631

BUSINESS INFORMATION:

* Please provide the information indicated, and include area codes when listing telephone numbers.

BUSINESS DESCRIPTION:

* If you know the North America Industry Classification System (NAICS) code, for your business

fill in the blank. Provide a detailed description of your business, including products sold

and services provided. Check the box best describing your business.

* Type of Ownership:

Sole Proprietorship: Business is owned and operated by a single individual.

LLC: Limited Liability Company - combines the tax attributes of a partnership with the attributes

of a corporation for liability purposes. An LLC may have one or several members and

is created by filing "Articles of Organization" with the Secretary of State

Partnership: Business is owned by two or more individuals or other business entities.

Corporation: "C" Corporation - A legal entity existing separately from the parties creating the entity.

"Articles of Incorporation" are filed with the Secretary of State and bylaws are adopted.

LLP: Limited Liability Partnership or Limited Liability Limited Partnerships (LLLP) - Legal

Limited Liabililty Limited Partnership Act (7/1/95) created a legal structure similar to S Corp

and a LLC. A "Registration Statement" is filed with the Secretary of State.

Other: Please select this category, and give a brief description if the entity is a Subchapter S ("S")

Corporation, a Limited Partnership Association, or a Nonprofit Organization

or any other type of ownership.

MAILING AND CONTACT INFORMATION:

Please provide the requested information, even if it is the same as the business information.

If this is a new business, or an existing business was purchased, and is physically located

in Greeley, the applicant will need to file an Initial Use Tax return, and pay any applicable use tax.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4