Instructions For Form Tpt-Ez - Transaction Privilege, Use, And Severance Tax Return Page 2

ADVERTISEMENT

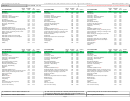

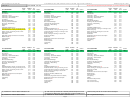

Transaction Privilege, Use, and Severance Tax Return (TPT‑EZ)

INSTRUCTIONS

Summary Totals

Page 1

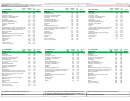

TRANSACTION PRIVILEGE, USE, AND SEVERANCE TAX RETURN - (TPT-EZ)

Arizona Department of Revenue

Form TPT-EZ is for filing

PO Box 29010 - Phoenix, AZ 85038-9010

TPT-EZ return is due the 20th day of the month following

periods beginning on or

For assistance out of state or in the Phoenix area: (602) 255-3381 or

5

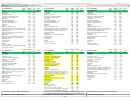

Line AA: Net AZ/County Tax

the month in which the transactions were conducted

after June 1, 2016.

Statewide, toll free area codes 520 and 928: (800) 352-4090

TAXPAYER IDENTIFICATION NUMBER

SSN

EIN

2

Enter the amount from Page 2, line 7, column M of this form.

3

LICENSE NUMBER

TAXPAYER INFORMATION

PERIOD BEGINNING

PERIOD ENDING

4

AMENDED RETURN

FINAL RETURN

CHECK HERE AND SIGN BELOW IF YOU

Line A1: State Excess Tax Collect

M

M D D Y Y Y Y

M

M D D Y Y Y Y

(Cancel License)

HAVE NO GROSS RECEIPTS TO REPORT

BUSINESS NAME

REVENUE USE ONLY. DO NOT MARK IN THIS AREA

1

C/O

By law, if you collected more tax than is calculated as due, the

MAILING ADDRESS

combined excess tax must be reported and paid to the Department of

CITY

STATE

ZIP CODE

Revenue. Enter State excess tax collected on this line.

POSTMARK DATE

RECEIVED DATE

BUSINESS PHONE NUMBER

ADDRESS CHANGED (MAILING ADDRESS ONLY)

Line A2: Excess Tax Accounting Credit

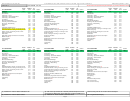

AA NET AZ/COUNTY TAX (PAGE 2, LINE 7, COLUMN (M)) ................................................................................................................................................................................................................

5

A1 STATE EXCESS TAX COLLECT ...............................................................................................................................................................................................................................................

If you are eligible to take an Accounting Credit, you may take an

A2 EXCESS TAX ACCOUNTING CREDIT .....................................................................................................................................................................................................................................

A3 SUBTOTAL (LINE AA + A1 – A2 = NET/AZ COUNTY TAX) .....................................................................................................................................................................................................

BB NET CITY TAX (PAGE 2, LINE 14, COLUMN (M)) ...........................................................................................................................................................................................................................

Accounting Credit for Excess Tax Collected. The Accounting Credit

B1 CITY EXCESS TAX COLLECTED .............................................................................................................................................................................................................................................

B2 SUBTOTAL (LINE BB + B1 = NET CITY TAX) ..........................................................................................................................................................................................................................

applies only to taxes paid for the state and not the counties.

CC NET TAX DUE ON THIS RETURN (LINE A3 + LINE B2 = LINE CC) ..............................................................................................................................................................................................

DD TPT ESTIMATED PAYMENTS TO BE USED ON THIS RETURN (JUNE RETURN ONLY, DUE IN JULY) ....................................................................................................................................

EE TAX DUE NET OF TPT ESTIMATED PAYMENTS (LINE CC - LINE DD = LINE EE) ......................................................................................................................................................................

Line A3: Subtotal

$

FF TOTAL AMOUNT REMITTED WITH THIS RETURN........................................................................................................................................................................................................................

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct and

complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

6

The taxpayer designates the individual listed below as the person to contact to schedule an audit of

Add lines AA and A1, subtract line A2, enter the results on this line.

this return and authorizes the disclosure of confidential information to this individual.

TAXPAYER PRINTED NAME

PAID PREPARER’S PRINTED NAME (OTHER THAN TAXPAYER)

PAID PREPARER’S TIN

Line BB: Net City Tax

TAXPAYER SIGNATURE

DATE

Enter the amount from Page 2, line 14, column M of this form. If there

TAXPAYER PHONE NO.

TITLE

PAID PREPARER’S SIGNATURE (OTHER THAN TAXPAYER)

PAID PREPARER’S PHONE

PLEASE MAKE CHECK PAYABLE TO: ARIZONA DEPARTMENT OF REVENUE

is only city tax reported, complete the city detail and Schedule A City

ADOR 11263 (4/16)

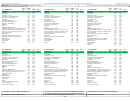

The following numbered instructions correspond to the numbers on

section only.

the sample Form TPT‑EZ.

Line B1: City Excess Tax Collect

If the return is an amended return, if you are canceling your license

By law, if you collected more tax than is calculated as due, the

and this is your final return, or if you have no gross receipts (zero

sales income) to report, please check the appropriate box.

combined excess must be reported and paid to the Department of

Revenue. Enter city excess tax collected on this line.

NOTE: The “Check here and sign below if you have no gross

Line B2: Subtotal

receipts to report” check box is ONLY used if you are filing a

return to report that you have zero sales income or no gross

Add lines BB and B1, enter the results on this line.

receipts to report. Do not check this box if there is tax due and

Line CC: Net Tax Due

no payment is submitted with this return.

Add lines A3 and B2, enter the results on this line.

Taxpayer Information

Line DD: TPT Estimated Payments to be Used

on this Return

1

Business Name and Address

Enter the amount previously paid as an estimated tax payment. This

Make corrections on the form as required. If you make changes to the

only applies to the June TPT-EZ return due in July. If you are not

address, check the “Address Changed” box.

required to pay an annual estimated tax payment or did not make an

estimated tax payment, then leave this blank.

2

Taxpayer Identification Number

A Taxpayer Identification Number is required when filing any return;

Line EE: Tax Due Net of TPT Estimated Payment

enter either your federal employer identification number (EIN) or

Subtract line DD from line CC and enter the result on this line.

social security number (SSN).

Line FF: Total Amount Remitted with this Return

3

License Number

Enter the total amount remitted with this return.

This number should include all eight numerical digits. The license

6

Taxpayer’s Signature

number must also be entered in the top right hand corner of Page 2.

Enter your first and last name, and sign and date this form. Please

4

Reporting Period

include a daytime phone number.

Check the accuracy of the PERIOD BEGINNING and the PERIOD

NOTE: There are two different sections for transaction detail;

ENDING boxes, and make corrections as required. If this information

one is for State (AZ)/County transactions and the other is for

is missing, enter the correct periods in as (MMDDYYYY) format

City transactions.

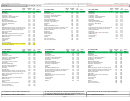

Page 2

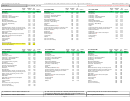

State (AZ)/County Transaction Detail

NOTE: A TRANSACTION DETAIL IS REQUIRED OR THE RETURN WILL NOT PROCESS CORRECTLY AND PENALTIES MAY APPLY.

STATE (AZ) /COUNTY TRANSACTION DETAIL (See Table 1 on the Tax Rate Table, )

(A)

(B)

(C)

(D)

(E)

(F)

(G)

(H)

(I)

(J)

(K)

(L)

(M)

DEDUCTIONS

AZ /

ACCTNG

(H) X (K) = (L)

(J) - (L) = (M)

REG.

NAME OF

BUS.

DESC. OF

GROSS

FROM

(F) - (G) = (H)

COUNTY

(H) X (I) = (J)

CREDIT

ACCOUNTING

AZ/COUNTY

CODE

REGION

CODE

BUS. ACTIVITY

RECEIPTS

SCHEDULE A

NET TAXABLE

TAX RATE

TOTAL TAX

RATE

CREDIT

TAX DUE

1

7

8

9

10

11

12

13

14

15

16

17

18

19

2

3

20

7 AZ/COUNTY SUBTOTAL (AMOUNT IN COLUMN M,

MUST EQUAL PAGE 1, LINE AA) ....................................

7

[Column A] - Leave blank

10

Business Code [Column D]

This column identifies the three digit number corresponding to your

Region Code [Column B]

8

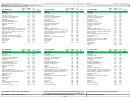

CITY TRANSACTION DETAIL (See Table 2 on the Tax Rate Table, )

business activity, which can be found in TAX RATE TABLES.

(A)

(B)

(C)

(D)

(E)

(F)

(G)

(H)

(I)

(J)

(K)

(L)

(M)

Enter the three letter region code for which you are remitting tax.

DEDUCTIONS

CITY

(J) - (L) = (M)

LOC.

CITY

BUS.

DESC. OF

FROM

(F) - (G) = (H)

TAX

(H) X (I) = (J)

CITY

CITY

11

Description of Business Activity [Column E]

CODE

CODE

NAME OF CITY

CODE

BUS. ACTIVITY

GROSS RECEIPTS

SCHEDULE A

NET TAXABLE

RATE

TOTAL TAX

CREDIT

TAX DUE

9

Name of Region [Column C]

8

This column will identify your type of business, or business activity.

21

22

23

24

25

26

27

28

29

30

31

32

33

Enter the name of the county or special region for which you are

9

remitting tax.

10

14 CITY SUBTOTAL (AMOUNT IN COLUMN M, MUST EQUAL PAGE 1,

34

Page 2

LINE BB) .................................................................................................

ADOR 11263 (8/16)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49