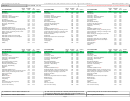

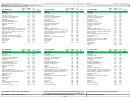

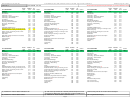

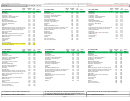

Instructions For Form Tpt-Ez - Transaction Privilege, Use, And Severance Tax Return Page 23

ADVERTISEMENT

Arizona State, County and City

Effective August 1, 2016

TRANSACTION PRIVILEGE AND OTHER TAX RATE TABLES

PROGRAM CITIES

TABLE 2

All tax rates are expressed as percentages (%) unless otherwise noted.

REGION

BUSINESS

TAX

REGION

BUSINESS

TAX

REGION

BUSINESS

TAX

COUNTY

COUNTY

COUNTY

CITY/TOWN NAME

CITY/TOWN NAME

CITY/TOWN NAME

CODE

CODE

RATE

CODE

CODE

RATE

CODE

CODE

RATE

COOLIDGE

CL

PNL

COTTONWOOD

CW

YAV

DEWEY-HUMBOLDT

DH

YAV

Advertising

018

3.00

Advertising

018

3.00

Advertising

018

2.00

Amusements

012

3.00

Amusements

012

3.00

Amusements

012

2.00

Contracting – Prime

015

4.00

Contracting – Prime

015

4.00

Contracting – Prime

015

2.00

Contracting – Speculative Builders

016

4.00

Contracting – Speculative Builders

016

4.00

Contracting – Speculative Builders

016

2.00

Contracting – Owner Builder

Contracting – Owner Builder

Contracting – Owner Builder

037

4.00

037

4.00

037

2.00

Feed at Wholesale

116

3.00

Job Printing

010

3.00

Job Printing

010

2.00

Job Printing

010

3.00

Manufactured Buildings

027

3.00

Manufactured Buildings

027

2.00

Manufactured Buildings

027

3.00

Timbering and Other Extraction

020

3.00

Timbering and Other Extraction

020

2.00

Timbering and Other Extraction

020

3.00

Severance – Metal Mining

019

0.10

Severance – Metal Mining

019

0.10

Severance – Metal Mining

019

0.10

Publication

009

3.00

Publication

009

2.00

Publication

009

3.00

Hotels

044

3.00

Hotels

044

2.00

B

B

Hotels

044

3.00

Hotel/Motel (Additional Tax)

144

3.00

Hotel/Motel (Additional Tax)

144

2.00

B

Residential Rental, Leasing, & Licensing for Use

Residential Rental, Leasing, & Licensing for Use

Hotel/Motel (Additional Tax)

144

3.00

045

3.00

045

2.00

Residential Rental, Leasing, & Licensing for Use

045

3.00

Commercial Rental, Leasing, & Licensing for Use

213

3.00

Commercial Rental, Leasing, & Licensing for Use

213

2.00

Commercial Rental, Leasing, & Licensing for Use

213

3.00

Rental Occupancy

040

3.00

Rental, Leasing, & Licensing for Use of TPP

214

2.00

Rental Occupancy

040

3.00

Rental, Leasing, & Licensing for Use of TPP

214

3.00

Restaurant and Bars

011

2.00

Rental, Leasing, & Licensing for Use of TPP

214

3.00

Restaurant and Bars

011

3.00

Retail Sales

017

2.00

Restaurant and Bars

011

3.00

Retail Sales

017

3.00

Retail Sales Food for Home Consumption

062

2.00

D

Retail Sales

Retail Sales Food for Home Consumption

MRRA Amount

017

3.00

062

3.00

315

2.00

D

Retail Sales (Single item over $10,000)

917

1.50

MRRA Amount

315

3.00

Communications

005

2.00

Retail Sales Food for Home Consumption

062

3.00

Communications

005

3.00

Transporting

006

2.00

D

MRRA Amount

315

3.00

Transporting

006

3.00

Utilities

004

2.00

Communications

005

3.00

Utilities

004

1.00

Use Tax Purchases

029

2.00

Transporting

006

3.00

Use Tax From Inventory

030

2.00

Utilities

004

3.00

Use Tax Purchases

029

3.00

Use Tax Purchases (Single item over $10,000)

929

1.50

Use Tax From Inventory

030

3.00

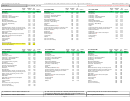

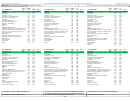

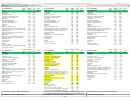

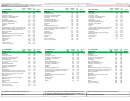

REGION

BUSINESS

TAX

REGION

BUSINESS

TAX

REGION

BUSINESS

TAX

COUNTY

COUNTY

COUNTY

CITY/TOWN NAME

CITY/TOWN NAME

CITY/TOWN NAME

CODE

CODE

RATE

CODE

CODE

RATE

CODE

CODE

RATE

DUNCAN

DC

GRN

EAGAR

EG

APA

EL MIRAGE

EM

MAR

Advertising

018

2.00

Amusements

012

3.00

Advertising

018

3.00

Amusements

012

2.00

Contracting – Prime

015

3.00

Amusements

012

3.00

Contracting – Prime

015

2.00

Contracting – Speculative Builders

016

3.00

Contracting – Prime

015

3.00

Contracting – Speculative Builders

016

2.00

Contracting – Owner Builder

037

3.00

Contracting – Speculative Builders

016

3.00

Contracting – Owner Builder

037

2.00

Job Printing

010

3.00

Contracting – Owner Builder

037

3.00

Job Printing

010

2.00

Manufactured Buildings

027

3.00

Job Printing

010

3.00

Manufactured Buildings

027

2.00

Timbering and Other Extraction

020

3.00

Manufactured Buildings

027

3.00

Timbering and Other Extraction

Severance – Metal Mining

Timbering and Other Extraction

020

2.00

019

0.10

020

3.00

Severance – Metal Mining

019

0.10

Publication

009

3.00

Severance – Metal Mining

019

0.10

Publication

009

2.00

Hotels

044

3.00

Publication

009

3.00

B

Hotels

044

2.00

Hotel/Motel (Additional Tax)

144

3.00

Hotels

044

3.00

B

B

Hotel/Motel (Additional Tax)

144

3.00

Residential Rental, Leasing, & Licensing for Use

045

3.00

Hotel/Motel (Additional Tax)

144

2.00

Residential Rental, Leasing, & Licensing for Use

045

2.00

Commercial Rental, Leasing, & Licensing for Use

213

3.00

Residential Rental, Leasing, & Licensing for Use

045

3.00

Commercial Rental, Leasing, & Licensing for Use

Rental Occupancy

Commercial Rental, Leasing, & Licensing for Use

213

2.00

040

3.00

213

3.00

Rental, Leasing, & Licensing for Use of TPP

Rental, Leasing, & Licensing for Use of TPP

Rental, Leasing, & Licensing for Use of TPP

214

2.00

214

3.00

214

3.00

Restaurant and Bars

011

2.00

Restaurant and Bars

011

3.00

Restaurant and Bars

011

3.00

Retail Sales

017

2.00

Retail Sales

017

3.00

Retail Sales

017

3.00

Retail Sales Food for Home Consumption

062

2.00

Retail Sales (Single Item over $1,000)

157

2.00

Retail Sales Food for Home Consumption

062

3.00

D

D

MRRA Amount

315

2.00

Retail Sales Food for Home Consumption

062

3.00

MRRA Amount

315

3.00

D

Communications

005

2.00

MRRA Amount

315

3.00

Communications

005

3.00

Transporting

Communications

Transporting

006

2.00

005

3.00

006

3.00

Utilities

004

2.00

Transporting

006

3.00

Utilities

004

3.00

Utilities

004

3.00

Use Tax Purchases

029

3.00

Use Tax Purchases

029

3.00

Use Tax From Inventory

030

3.00

Use Tax Purchases (Single item over $1,000)

159

2.00

Use Tax From Inventory

030

3.00

(A) “Additional Tax” means in addition to Restaurant Tax.

(D) Code used to report amount due on materials purchased exempt from tax and

Review each City/Town for tax on Food for Home Consumption.

incorporated into a Maintenance, Repair, Replacement or Alteration (MRRA) project.

(B) “Additional Tax” means in addition to Hotel.

(C) “Additional Tax” means in addition to Commercial Lease.

TPP = Tangible Personal Property.

Page 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49