Instructions For Form Tpt-Ez - Transaction Privilege, Use, And Severance Tax Return Page 5

ADVERTISEMENT

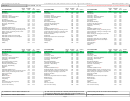

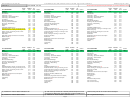

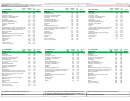

Arizona State, County and City

Effective September 1, 2016

TRANSACTION PRIVILEGE AND OTHER TAX RATE TABLES

The following tables contain the rates for Transaction Privilege and other taxes imposed by the State of Arizona, the counties, and most Arizona cities:

• Table 1 provides the tax rates which combine the state’s transaction privilege tax rate and the county excise tax rate. Table 1 also includes accounting

credit rates for applicable classifications on STATE TAX ONLY.

• Table 2 contains a list of all the city privilege tax rates and city codes for program cities. The Arizona Department of Revenue collects these taxes for

program cities.

• Table 3 contains a list of non-program cities and their telephone numbers. These cities collect their own taxes. Sales in these cities must be reported

directly to the applicable city.

• Table 4 contains county identification codes and Special District Codes which must be used on the tax return (Form TPT-1) in the column marked

Region Code.

• Table 5 contains special region codes to be used on the tax return (Form TPT-1) in the column marked Region Code by businesses that operate on Indian

Reservations.

TABLE 1

TAX RATES FOR SALES IN THESE COUNTIES

Apache

(APA)

Santa

Accounting

Greenlee

Credit Rate

Cochise

Coconino

Gila

Graham

La Paz

Maricopa

Mohave

Pima

Pinal

Cruz

Yavapai

Yuma

Business

(GRN)

(STATE TAX

Code

TAXABLE ACTIVITIES

(COH)

(COC)

(GLA)

(GRA)

(LAP)

(MAR)

(MOH)

(PMA)

(PNL)

(STC)

(YAV)

(YMA)

a

ONLY)

Navajo

(NAV)

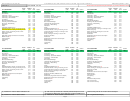

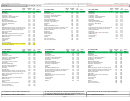

002

Mining–Nonmetal

3.437%

4.05%

3.75% 3.75% 4.375% 3.562%

3.281% 3.437% 3.805%

3.75%

3.593%

3.812%

3.437%

.0312%

004

Utilities

6.10%

6.90%

6.60% 6.60%

7.60%

6.30%

5.85%

6.10%

6.70%

6.60%

6.35%

6.712%

6.10%

.056%

005

Communications

6.10%

6.90%

6.60% 6.60%

7.60%

6.30%

5.85%

6.10%

6.70%

6.60%

6.35%

6.712%

6.10%

.056%

k

006

Transporting

6.10%

6.90%

6.60% 6.60%

7.60%

6.30%

5.85%

6.10%

6.70%

6.60%

6.35%

6.712%

6.10%

.056%

007

Private (Rail) Car

6.10%

6.90%

6.60% 6.60%

7.60%

6.30%

5.85%

6.10%

6.70%

6.60%

6.35%

6.712%

6.10%

.056%

008

Pipeline

6.10%

6.90%

6.60% 6.60%

7.60%

6.30%

5.85%

6.10%

6.70%

6.60%

6.35%

6.712%

6.10%

.056%

009

Publication

6.10%

6.90%

6.60% 6.60%

7.60%

6.30%

5.85%

6.10%

6.70%

6.60%

6.35%

6.712%

6.10%

.056%

010

Job Printing

6.10%

6.90%

6.60% 6.60%

7.60%

6.30%

5.85%

6.10%

6.70%

6.60%

6.35%

6.712%

6.10%

.056%

011

Restaurants and Bars

6.10%

6.90%

6.60% 6.60%

7.60%

6.30%

5.85%

6.10%

6.70%

6.60%

6.35%

6.712%

6.10%

.056%

012

Amusement

6.10%

6.90%

6.60% 6.60%

7.60%

6.30%

5.85%

6.10%

6.70%

6.60%

6.35%

6.712%

6.10%

.056%

013

Commercial Lease

0

0.3%

0.5%

0

0

0.5%

0

0.5%

0.5%

0

0

0

0

0

014

Personal Property Rental

6.10%

6.90%

6.60% 6.60%

7.60%

6.30%

5.85%

6.10%

6.70%

6.60%

6.35%

6.712%

6.10%

.056%

015

Contracting–Prime

6.10%

6.90%

6.60% 6.60%

7.60%

6.30%

5.85%

6.10%

6.70%

6.60%

6.35%

6.712%

6.10%

.056%

017

Retail

6.10%

6.90%

6.60% 6.60%

7.60%

6.30%

5.85%

6.10%

6.70%

6.60%

6.35%

6.712%

6.10%

.056%

315

MRRA Amount

6.10%

6.90%

6.60% 6.60%

7.60%

6.30%

5.85%

6.10%

6.70%

6.60%

6.35%

6.712%

6.10%

N/A

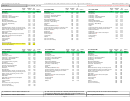

l

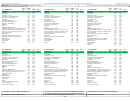

019

Severance–Metalliferous Mining

2.50%

2.50%

2.50% 2.50%

2.50%

2.50%

2.50%

2.50%

2.50%

2.50%

2.50%

2.50%

2.50%

.025%

023

Recreational Vehicle Surcharge

0

0

0

0

0

0

0

50¢

0

0

0

0

0

N/A

f

025

Transient Lodging

6.05%

6.90%

6.60% 6.55%

7.7%

7.27%

5.78%

6.05%

6.698%

6.60%

6.325%

6.71%

6.05%

.055%

b

026

Use Tax–Utilities

6.10%

5.90%

5.60% 6.10%

6.10%

5.60%

5.60%

6.10%

6.10%

5.60%

5.60%

6.60%

5.60%

N/A

029

Use Tax Purchases

5.60%

5.60%

5.60% 5.60%

5.60%

5.60%

5.60%

5.60%

5.60%

5.60%

5.60%

5.60%

5.60%

N/A

030

Use Tax From Inventory

5.60%

5.60%

5.60% 5.60%

5.60%

5.60%

5.60%

5.60%

5.60%

5.60%

5.60%

5.60%

5.60%

N/A

033

Telecommunications Devices

1.10%

1.10%

1.10% 1.10%

1.10%

1.10%

1.10%

1.10%

1.10%

1.10%

1.10%

1.10%

1.10%

N/A

041

Municipal Water

65¢

65¢

65¢

65¢

65¢

65¢

65¢

65¢

65¢

65¢

65¢

65¢

65¢

N/A

c

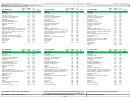

049

Jet Fuel Tax

3.355¢

3.965¢

3.66¢

3.66¢

4.27¢

3.355¢

3.202¢

3.355¢

3.66¢

3.66¢

3.507¢

3.660¢

3.355¢

N/A

d

051

Jet Fuel Use Tax

3.05¢

3.05¢

3.05¢

3.05%

3.05¢

3.05¢

3.05¢

3.05¢

3.05¢

3.05¢

3.05¢

3.05¢

3.05¢

N/A

d

053/055 Rental Car Surcharge

0

0

0

0

0

$2.50

0

$3.50

0

0

0

0

0

N/A

e, h

129

Use Tax Direct Payments

5.60%

5.60%

5.60% 5.60%

5.60%

5.60%

5.60%

5.60%

5.60%

5.60%

5.60%

5.60%

5.60%

N/A

i

153

Rental Car Surcharge–Stadium

0

0

0

0

0

3.25%

0

0

0

0

0

0

0

N/A

h

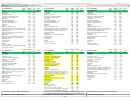

911

911 Telecommunications

20¢

20¢

20¢

20¢

20¢

20¢

20¢

20¢

20¢

20¢

20¢

20¢

20¢

N/A

g

912

E911 Prepaid Wireless

0. 8%

0. 8%

0. 8%

0. 8%

0. 8%

0. 8%

0. 8%

0. 8%

0. 8%

0. 8%

0. 8%

0. 8%

0. 8%

N/A

j

a)

Reduced rates may apply to preexisting contracts without pass through clauses. For information, see the Department’s web site at

b)

Unincorporated areas of Pima County add 6%. (Report using region code PH and class code 000.)

c)

Rate is cents per 1,000 gallons of water. The tax on 100,000 gallons is thus 65 cents. Business code 041 should only be reported in region code SWD.

d)

Rate is cents per gallon up to 10 million gallons.

e)

Class 53 is for Maricopa filers. Class 55 is for Pima filers.

f)

Rate is 50¢ per day on each lease or rental of a parking space for recreational vehicles. (Pima County only)

g)

Monthly rate per activated service.

h)

The Maricopa County rental Car Surcharge is the greater of $2.50 or 3.25% of the gross income of each contract. Report $2.50 per contract in Class 053.

Report the remainder in Class 153.

i)

For use by direct pay permit holders only.

j)

Prepaid wireless Communications retailers.

k)

Telecom Service Providers may be required to report under Business Codes 033 & 911 in addition to Business Code 005.

l)

Code used to report amount due on materials purchased exempt from tax and incorporated into a Maintenance, Repair, Replacement or Alteration (MRRA)

project.

ARIZONA DEPARTMENT OF REVENUE

ADOR/CITIES UNIT 99750 (11/15)

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49