Instructions For Form Tpt-Ez - Transaction Privilege, Use, And Severance Tax Return Page 3

ADVERTISEMENT

Transaction Privilege, Use, and Severance Tax Return (TPT‑EZ)

INSTRUCTIONS

12

Gross Receipts [Column F]

in decimal form . Do not include the percent sign (%) with the amount.

For example, 6.5% should be entered as .065.

For each line item (reported business activity by county or region),

enter the gross amount collected.

Accounting Credit

13

Deductions from Schedule A [Column G]

The State of Arizona provides a credit for accounting and reporting

expenses. The accounting credit is applicable only to Transaction

Enter the amount from Schedule A.

Privilege Tax or Severance Tax; it does not apply to city, county or

14

Net Taxable Amount [Column H]

other taxes. The credit is equal to 1% of the amount of state tax due,

Subtract column G from column F. This is the net income subject to tax.

but cannot exceed $10,000 per business entity for a calendar year.

15

18

AZ/County Tax Rate [Column I]

Accounting Credit [Column L]

Find the combined state/county tax rates in the TAX RATE TABLES.

Multiply column H by column K. Enter the result in column L. This is

Enter the percentage in decimal form . Do not include the percent sign

your accounting credit.

(%) with the amount. For example, 6.5% should be entered as .065.

AZ/County Tax Due [Column M]

19

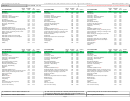

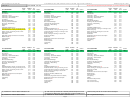

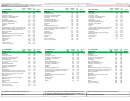

STATE (AZ) /COUNTY TRANSACTION DETAIL (See Table 1 on the Tax Rate Table, )

16

Total Tax Amount [Column J]

(A)

(B)

(C)

(D)

(E)

(F)

(G)

(H)

(I)

(J)

(K)

(L)

(M)

Subtract column L from column J. This is the tax due for this line item.

DEDUCTIONS

AZ /

ACCTNG

(H) X (K) = (L)

(J) - (L) = (M)

REG.

NAME OF

BUS.

DESC. OF

GROSS

FROM

(F) - (G) = (H)

COUNTY

(H) X (I) = (J)

CREDIT

ACCOUNTING

AZ/COUNTY

Multiply column H by column I. Enter the result in column J.

CODE

REGION

CODE

BUS. ACTIVITY

RECEIPTS

SCHEDULE A

NET TAXABLE

TAX RATE

TOTAL TAX

RATE

CREDIT

TAX DUE

20

AZ/County Subtotal Line 7

17

Accounting Credit Rate [Column K]

1

7

8

9

10

11

12

13

Total amounts in each of the columns F, G, H, J, L and M. Enter the

14

15

16

17

18

19

2

The accounting credit rate for your business activity should be

result on this line for each column. Enter result on this line and on

3

preprinted on the form. You can find the combined state and county

20

Page 1, line AA.

7 AZ/COUNTY SUBTOTAL (AMOUNT IN COLUMN M,

tax rates by checking the TAX RATE TABLES. Enter the percentage

MUST EQUAL PAGE 1, LINE AA) ....................................

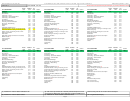

City Transaction Detail

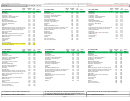

CITY TRANSACTION DETAIL (See Table 2 on the Tax Rate Table, )

(A)

(B)

(C)

(D)

(E)

(F)

(G)

(H)

(I)

(J)

(K)

(L)

(M)

DEDUCTIONS

CITY

(J) - (L) = (M)

LOC.

CITY

BUS.

DESC. OF

FROM

(F) - (G) = (H)

TAX

(H) X (I) = (J)

CITY

CITY

CODE

CODE

NAME OF CITY

CODE

BUS. ACTIVITY

GROSS RECEIPTS

SCHEDULE A

NET TAXABLE

RATE

TOTAL TAX

CREDIT

TAX DUE

8

21

22

23

24

25

26

27

28

29

30

31

32

33

9

10

14 CITY SUBTOTAL (AMOUNT IN COLUMN M, MUST EQUAL PAGE 1,

34

LINE BB) .................................................................................................

If only city tax is reported on Form TPT‑EZ, complete the city detail and Schedule A City only.

NOTE: A TRANSACTION DETAIL IS REQUIRED OR THE RETURN WILL NOT PROCESS CORRECTLY AND PENALTIES MAY APPLY.

21

Location Code [Column A]

28

Net Taxable Amount [Column H]

This is a three digit numeric code that identifies each location where

Subtract column G from column F. This is the net income subject to tax.

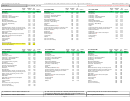

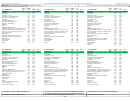

SCHEDULE A - DEDUCTION DETAIL INFORMATION

SCHEDULE A - DEDUCTION DETAIL INFORMATION

STATE (AZ) /COUNTY TRANSACTION DETAIL (See Table 1 on the Tax Rate Table, )

you are doing business. This code can be found on your printed

STATE (AZ) /COUNTY DEDUCTIONS DETAIL

CITY DEDUCTIONS DETAIL

29

City Tax Rate [Column I]

(A)

(B)

(C)

(D)

(E)

(F)

(G)

(H)

(I)

(J)

(K)

(L)

(M)

license.

(A)

(B)

(C)

(D)

(E)

(F)

(A)

(B)

(C)

(D)

(E)

(F)

(H) X (K) = (L)

(J) - (L) = (M)

DEDUCTIONS

AZ /

ACCTNG

You can find the tax rates by checking the TAX RATE TABLES. Enter

REG.

NAME OF

BUS.

DESC. OF

GROSS

FROM

(F) - (G) = (H)

COUNTY

(H) X (I) = (J)

CREDIT

ACCOUNTING

AZ/COUNTY

22

REGION

BUS.

DEDUCTION

DESCRIPTION OF

LOC.

CITY

BUS.

DEDUCTION

DESCRIPTION OF

City Code [Column B]

CODE

REGION

CODE

BUS. ACTIVITY

RECEIPTS

SCHEDULE A

NET TAXABLE

TAX RATE

TOTAL TAX

RATE

CREDIT

TAX DUE

the percentage in decimal form . Do not include the percent sign (%)

CODE

CODE

CODE

DEDUCTION AMOUNT

DEDUCTION CODE

CODE

CODE

CODE

CODE

DEDUCTION AMOUNT

DEDUCTION CODE

1

$

$

1

8

Enter the two letter city code for which you are remitting tax.

with the amount. For example, 6.5% should be entered as .065.

42

43

44

45

46

35 36 37

38

39

40

47

7

8

9

10

11

12

13

14

15

16

17

18

19

$

$

2

9

2

30

Total Tax Amount [Column J]

23

Name of City [Column C]

$

$

3

10

3

20

41

$

$

6 AZ/COUNTY TOTAL DEDUCTIONS

11

7 AZ/COUNTY SUBTOTAL (AMOUNT IN COLUMN M,

Multiply column H by column I. Enter the result in column J.

Enter the name of the city for which you are remitting tax.

$

TOTAL MUST EQUAL TOTAL ON PAGE 2, LINE 7, COLUMN G

12

MUST EQUAL PAGE 1, LINE AA) ....................................

48

$

13 CITY TOTAL DEDUCTIONS .................

24

Business Code [Column D]

31

[Column K] - Leave blank

TOTAL MUST EQUAL TOTAL ON PAGE 2, LINE 14, COLUMN G

This column identifies the three digit number corresponding to your

32

City Credit [Column L]

business activity, which can be found in TAX RATE TABLES.

FOR USE BY OWNER-BUILDERS OR SPECULATIVE BUILDERS

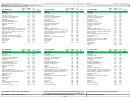

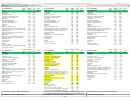

CITY TRANSACTION DETAIL (See Table 2 on the Tax Rate Table, )

25

Description of Business Activity [Column E]

(A)

(B)

(C)

(D)

(E)

(F)

(G)

(H)

(I)

(J)

(K)

(L)

(M)

ONLY.

This tax credit cannot be taken by a construction

DEDUCTIONS

CITY

(J) - (L) = (M)

In this column provide a brief explanation of your business activity.

LOC.

CITY

BUS.

DESC. OF

FROM

contractor as an offset to the tax due on construction contracting

(F) - (G) = (H)

TAX

(H) X (I) = (J)

CITY

CITY

CODE

CODE

NAME OF CITY

CODE

BUS. ACTIVITY

GROSS RECEIPTS

SCHEDULE A

NET TAXABLE

RATE

TOTAL TAX

CREDIT

TAX DUE

Gross Receipts [Column F]

26

receipts or draws.

8

21

22

23

24

25

26

27

28

29

30

31

32

33

For each line item (reported business activity by city or town), enter

33

City Tax Due [Column M]

9

the gross amount collected.

10

Subtract column L from column J. This is the tax due for this line item.

14 CITY SUBTOTAL (AMOUNT IN COLUMN M, MUST EQUAL PAGE 1,

27

Deductions from Schedule A [Column G]

34

LINE BB) .................................................................................................

City Subtotal Line 14

34

Enter the amount from Schedule A.

Total amounts in each of the columns F, G, H, J, L and M. Enter the

result on this line for each column and enter this result on Page 1, line BB.

SCHEDULE A DEDUCTIONS: STATE (AZ)/COUNTY

35

[Column A] - Leave blank

SCHEDULE A - DEDUCTION DETAIL INFORMATION

SCHEDULE A - DEDUCTION DETAIL INFORMATION

STATE (AZ) /COUNTY DEDUCTIONS DETAIL

CITY DEDUCTIONS DETAIL

(A)

(B)

(C)

(D)

(E)

(F)

(A)

(B)

(C)

(D)

(E)

(F)

Region Code [Column B]

36

REGION

BUS.

DEDUCTION

DESCRIPTION OF

LOC.

CITY

BUS.

DEDUCTION

DESCRIPTION OF

Enter the three letter region code for which you are remitting tax.

CODE

CODE

CODE

DEDUCTION AMOUNT

DEDUCTION CODE

CODE

CODE

CODE

CODE

DEDUCTION AMOUNT

DEDUCTION CODE

$

$

1

8

42

43

44

45

46

35 36 37

38

39

40

47

37

Business Code [Column C]

$

$

2

9

$

$

3

10

This column identifies the three digit number corresponding to your

41

$

$

6 AZ/COUNTY TOTAL DEDUCTIONS

11

business activity, which can be found in TAX RATE TABLES.

$

TOTAL MUST EQUAL TOTAL ON PAGE 2, LINE 7, COLUMN G

12

48

$

13 CITY TOTAL DEDUCTIONS .................

38

Deduction Code [Column D]

Schedule A must be completed for deductions to be

TOTAL MUST EQUAL TOTAL ON PAGE 2, LINE 14, COLUMN G

allowed.

Choose the appropriate deduction code from the Deduction Code list.

Page 3

ADOR 11263 (8/16)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49