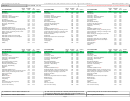

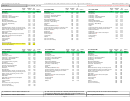

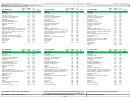

Instructions For Form Tpt-Ez - Transaction Privilege, Use, And Severance Tax Return Page 42

ADVERTISEMENT

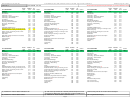

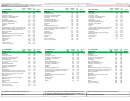

Arizona State, County and City

Effective July 1, 2016

TRANSACTION PRIVILEGE AND OTHER TAX RATE TABLES

PROGRAM CITIES

TABLE 2

All tax rates are expressed as percentages (%) unless otherwise noted.

REGION

BUSINESS

TAX

REGION

BUSINESS

TAX

REGION

BUSINESS

TAX

COUNTY

COUNTY

COUNTY

CITY/TOWN NAME

CITY/TOWN NAME

CITY/TOWN NAME

CODE

CODE

RATE

CODE

CODE

RATE

CODE

CODE

RATE

MARANA

MA

PMA/PNL

MARICOPA

MP

PNL

MIAMI

MM

GLA

Amusements

012

2.50

Advertising

018

2.00

Advertising

018

2.50

Contracting – Prime

015

4.00

Amusements

012

2.00

Amusements

012

2.50

Contracting – Speculative Builders

016

4.00

Contracting – Prime

015

3.50

Contracting – Prime

015

2.50

Contracting – Owner Builder

037

4.00

Contracting – Speculative Builders

016

3.50

Contracting – Speculative Builders

016

2.50

Job Printing

Contracting – Owner Builder

Contracting – Owner Builder

010

2.50

037

3.50

037

2.50

Manufactured Buildings

027

2.50

Job Printing

010

2.00

Job Printing

010

2.50

Timbering and Other Extraction

020

2.50

Manufactured Buildings

027

2.00

Manufactured Buildings

027

2.50

Severance – Metal Mining

019

0.10

Timbering and Other Extraction

020

2.00

Timbering and Other Extraction

020

2.50

Publication

009

2.50

Severance – Metal Mining

019

0.10

Severance – Metal Mining

019

0.10

Hotels

044

2.50

Publication

009

2.00

Publication

009

2.50

B

Hotel/Motel (Additional Tax)

144

6.00

Hotels

044

2.00

Hotels

044

2.50

B

Commercial Rental, Leasing, & Licensing for Use

213

2.50

Hotel/Motel (Additional Tax)

144

2.00

Residential Rental, Leasing, & Licensing for Use

045

2.50

Rental Occupancy

Residential Rental, Leasing, & Licensing for Use

Commercial Rental, Leasing, & Licensing for Use

040

2.50

045

2.00

213

2.50

Rental, Leasing, & Licensing for Use of TPP

214

2.50

Commercial Rental, Leasing, & Licensing for Use

213

2.00

Rental, Leasing, & Licensing for Use of TPP

214

2.50

Restaurant and Bars

011

2.50

Rental, Leasing, & Licensing for Use of TPP

214

2.00

Restaurant and Bars

011

2.50

Retail Sales

017

2.50

Restaurant and Bars

011

2.00

Retail Sales

017

2.50

Retail Sales (Single Item Portion over $5,000)

357

2.00

Retail Sales

017

2.00

Retail Sales Food for Home Consumption

062

2.50

D

D

MRRA Amount

315

2.50

Retail Sales Food for Home Consumption

062

2.00

MRRA Amount

315

2.50

D

Communications

MRRA Amount

Communications

005

4.50

315

2.00

005

2.50

Transporting

006

2.50

Communications

005

2.00

Transporting

006

2.50

Utilities

004

4.50

Transporting

006

2.00

Use Tax Purchases

029

2.50

Utilities

004

2.00

Use Tax Purch (Single Item Portion over $5,000)

359

2.00

Use Tax Purchases

029

2.00

Use Tax From Inventory

030

2.50

Use Tax From Inventory

030

2.00

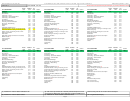

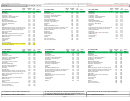

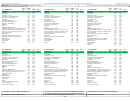

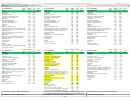

REGION

BUSINESS

TAX

REGION

BUSINESS

TAX

REGION

BUSINESS

TAX

COUNTY

COUNTY

COUNTY

CITY/TOWN NAME

CITY/TOWN NAME

CITY/TOWN NAME

CODE

CODE

RATE

CODE

CODE

RATE

CODE

CODE

RATE

ORO VALLEY

OR

PMA

PAGE

PG

COC

PARADISE VALLEY

PV

MAR

Advertising

018

2.50

Advertising

018

3.00

Advertising

018

2.50

Amusements

012

2.50

Amusements

012

3.00

Amusements

012

2.50

Contracting – Prime

015

4.00

Contracting – Prime

015

3.00

Contracting – Prime

015

2.50

Contracting – Speculative Builders

016

4.00

Contracting – Speculative Builders

016

3.00

Contracting – Speculative Builders

016

2.50

Contracting – Owner Builder

037

4.00

Contracting – Owner Builder

037

3.00

Contracting – Owner Builder

037

2.50

Job Printing

Job Printing

Job Printing

010

2.50

010

3.00

010

2.50

Manufactured Buildings

027

2.50

Manufactured Buildings

027

3.00

Manufactured Buildings

027

2.50

Timbering and Other Extraction

020

2.50

Timbering and Other Extraction

020

3.00

Timbering and Other Extraction

020

2.50

Severance – Metal Mining

019

0.10

Severance – Metal Mining

019

0.10

Severance – Metal Mining

019

0.10

Publication

009

2.50

Publication

009

3.00

Publication

009

2.50

Hotels

044

2.50

Hotels

044

3.00

Hotels

044

2.50

B

B

B

Hotel/Motel (Additional Tax)

144

6.00

Hotel/Motel (Additional Tax)

144

4.263

Hotel/Motel (Additional Tax)

144

3.40

Rental Occupancy

Residential Rental, Leasing, & Licensing for Use

Residential Rental, Leasing, & Licensing for Use

040

2.00

045

3.00

045

1.65

Rental, Leasing, & Licensing for Use of TPP

Commercial Rental, Leasing, & Licensing for Use

Commercial Rental, Leasing, & Licensing for Use

214

2.50

213

3.00

213

1.65

C

Restaurant and Bars

011

2.50

Rental, Leasing, & Licensing for Use of TPP

214

3.00

313

0.85

Commercial Lease (Additional Tax)

Retail Sales

017

2.50

Restaurant and Bars

011

4.00

Rental Occupancy

040

1.65

D

MRRA Amount

315

2.50

Retail Sales

017

3.00

Rental, Leasing, & Licensing for Use of TPP

214

2.50

Transporting

006

2.50

Retail Sales (Single Item Portion over $3,000)

387

2.00

Restaurant and Bars

011

2.50

Utilities

004

4.00

Retail Sales Food for Home Consumption

062

3.00

Retail Sales

017

2.50

D

MRRA Amount

Retail Sales Food for Home Consumption

315

3.00

062

2.50

D

Communications

005

3.00

MRRA Amount

315

2.50

Transporting

006

3.00

Communications

005

2.50

Utilities

004

3.00

Transporting

006

2.50

Use Tax Purchases

029

3.00

Utilities

004

2.50

Use Tax Purch (Single Item Portion over $3,000)

389

2.00

Use Tax Purchases

029

2.50

Use Tax From Inventory

030

3.00

Use Tax From Inventory

030

2.50

(A) “Additional Tax” means in addition to Restaurant Tax.

(D) Code used to report amount due on materials purchased exempt from tax and

Review each City/Town for tax on Food for Home Consumption.

incorporated into a Maintenance, Repair, Replacement or Alteration (MRRA) project.

(B) “Additional Tax” means in addition to Hotel.

(C) “Additional Tax” means in addition to Commercial Lease.

TPP = Tangible Personal Property.

Page 8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49