Instructions For Form 1120-Sf - (Rev. December 2001)

ADVERTISEMENT

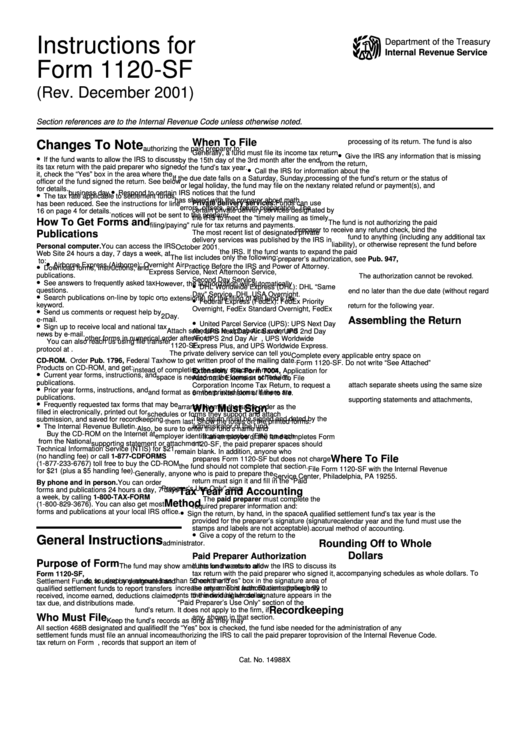

Instructions for

Department of the Treasury

Internal Revenue Service

Form 1120-SF

(Rev. December 2001)

U.S. Income Tax Return for Settlement Funds

Section references are to the Internal Revenue Code unless otherwise noted.

When To File

processing of its return. The fund is also

Changes To Note

authorizing the paid preparer to:

•

Generally, a fund must file its income tax return

•

Give the IRS any information that is missing

If the fund wants to allow the IRS to discuss

by the 15th day of the 3rd month after the end

from the return,

its tax return with the paid preparer who signed

•

of the fund’s tax year.

Call the IRS for information about the

it, check the “Yes” box in the area where the

If the due date falls on a Saturday, Sunday,

processing of the fund’s return or the status of

officer of the fund signed the return. See below

or legal holiday, the fund may file on the next

any related refund or payment(s), and

for details.

•

•

business day.

Respond to certain IRS notices that the fund

The tax rate applicable to settlement funds

has shared with the preparer about math

Private delivery services. Funds can use

has been reduced. See the instructions for line

errors, offsets, and return preparation. The

certain private delivery services designated by

16 on page 4 for details.

notices will not be sent to the preparer.

the IRS to meet the “timely mailing as timely

How To Get Forms and

The fund is not authorizing the paid

filing/paying” rule for tax returns and payments.

preparer to receive any refund check, bind the

The most recent list of designated private

Publications

fund to anything (including any additional tax

delivery services was published by the IRS in

liability), or otherwise represent the fund before

Personal computer. You can access the IRS

October 2001.

the IRS. If the fund wants to expand the paid

Web Site 24 hours a day, 7 days a week, at

The list includes only the following:

preparer’s authorization, see Pub. 947,

to:

•

•

Airborne Express (Airborne): Overnight Air

Practice Before the IRS and Power of Attorney.

Download forms, instructions, and

Express Service, Next Afternoon Service,

publications.

The authorization cannot be revoked.

•

Second Day Service.

See answers to frequently asked tax

•

However, the authorization will automatically

DHL Worldwide Express (DHL): DHL “Same

questions.

end no later than the due date (without regard

•

Day” Service, DHL USA Overnight.

Search publications on-line by topic or

•

to extensions) for the filing of the fund’s tax

Federal Express (FedEx): FedEx Priority

keyword.

return for the following year.

•

Overnight, FedEx Standard Overnight, FedEx

Send us comments or request help by

2Day.

Assembling the Return

e-mail.

•

•

United Parcel Service (UPS): UPS Next Day

Sign up to receive local and national tax

Air, UPS Next Day Air Saver, UPS 2nd Day

Attach schedules in alphabetical order and

news by e-mail.

Air, UPS 2nd Day Air A.M., UPS Worldwide

other forms in numerical order after Form

You can also reach us using file transfer

Express Plus, and UPS Worldwide Express.

1120-SF.

protocol at ftp.irs.gov.

The private delivery service can tell you

Complete every applicable entry space on

CD-ROM. Order Pub. 1796, Federal Tax

how to get written proof of the mailing date.

Form 1120-SF. Do not write “See Attached”

Products on CD-ROM, and get:

instead of completing the entry spaces. If more

Extension. File Form 7004, Application for

•

Current year forms, instructions, and

space is needed on the forms or schedules,

Automatic Extension of Time To File

publications.

attach separate sheets using the same size

Corporation Income Tax Return, to request a

•

Prior year forms, instructions, and

and format as on the printed forms. If there are

6-month extension of time to file.

publications.

supporting statements and attachments,

•

Frequently requested tax forms that may be

Who Must Sign

arrange them in the same order as the

filled in electronically, printed out for

schedules or forms they support and attach

submission, and saved for recordkeeping.

The return must be signed and dated by the

them last. Show the totals on the printed forms.

•

The Internal Revenue Bulletin.

administrator of the fund.

Also, be sure to enter the fund’s name and

Buy the CD-ROM on the Internet at

employer identification number (EIN) on each

If an employee of the fund completes Form

/cdorders from the National

supporting statement or attachment.

1120-SF, the paid preparer spaces should

Technical Information Service (NTIS) for $21

remain blank. In addition, anyone who

(no handling fee) or call 1-877-CDFORMS

Where To File

prepares Form 1120-SF but does not charge

(1-877-233-6767) toll free to buy the CD-ROM

the fund should not complete that section.

File Form 1120-SF with the Internal Revenue

for $21 (plus a $5 handling fee).

Generally, anyone who is paid to prepare the

Service Center, Philadelphia, PA 19255.

return must sign it and fill in the “Paid

By phone and in person. You can order

Preparer’s Use Only” area.

forms and publications 24 hours a day, 7 days

Tax Year and Accounting

a week, by calling 1-800-TAX-FORM

The paid preparer must complete the

Method

(1-800-829-3676). You can also get most

required preparer information and:

•

forms and publications at your local IRS office.

Sign the return, by hand, in the space

A qualified settlement fund’s tax year is the

provided for the preparer’s signature (signature

calendar year and the fund must use the

stamps and labels are not acceptable).

accrual method of accounting.

•

Give a copy of the return to the

General Instructions

Rounding Off to Whole

administrator.

Dollars

Paid Preparer Authorization

Purpose of Form

The fund may show amounts on the return and

If the fund wants to allow the IRS to discuss its

accompanying schedules as whole dollars. To

Form 1120-SF, U.S. Income Tax Return for

tax return with the paid preparer who signed it,

do so, drop any amount less than 50 cents and

Settlement Funds, is used by designated and

check the “Yes” box in the signature area of

increase any amount from 50 cents through 99

qualified settlement funds to report transfers

the return. This authorization applies only to

received, income earned, deductions claimed,

the individual whose signature appears in the

cents to the next higher dollar.

“Paid Preparer’s Use Only” section of the

tax due, and distributions made.

Recordkeeping

fund’s return. It does not apply to the firm, if

Who Must File

any, shown in that section.

Keep the fund’s records as long as they may

All section 468B designated and qualified

If the “Yes” box is checked, the fund is

be needed for the administration of any

settlement funds must file an annual income

authorizing the IRS to call the paid preparer to

provision of the Internal Revenue Code.

tax return on Form 1120-SF.

answer any questions that may arise during the

Usually, records that support an item of

Cat. No. 14988X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4