International Fuel Tax Agreement (Ifta) - Commonwealth Of Massachusetts Page 16

ADVERTISEMENT

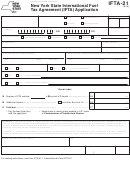

International Fuel Tax Agreement

16

Definitions

Base Jurisdiction

The member jurisdiction where qualified motor vehicles are based for vehicle registration purposes and:

➡ where the operational control and operational records of the licensee’s qualified motor vehicles are main-

tained or can be made available; and

➡ where some travel is accrued by qualified motor vehicles within the fleet. The commissioners of two or more

affected jurisdictions may allow a person to consolidate several fleets which would otherwise be based in

two or more jurisdictions.

Cancellation

The annulment of a license and its provisions by either the licensing jurisdiction or the licensee.

Commissioner

The official designated by the jurisdiction to be responsible for administration of this agreement.

Fleet

One or more vehicles.

In-Jurisdiction Miles (distance)

The total number of miles or kilometers operated by a registrant’s/licensee’s qualified motor vehicles within a

jurisdiction. In-jurisdiction miles or kilometers do not include those operated on a fuel tax trip permit or those

exempted from fuel taxation by a jurisdiction.

Jurisdiction

A state of the United States, the District of Columbia or a province or territory of Canada.

Lessee

The party acquiring the use of equipment with or without a driver from another.

Lessor

The party granting the use of equipment with or without a driver to another.

Licensee

A person who holds an uncanceled agreement license issued by the base jurisdiction.

Motor Fuels

All fuels used for the generation of power for propulsion of qualified motor vehicles.

Person

An individual, corporation, partnership, association, trust or other entity.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17