International Fuel Tax Agreement (Ifta) - Commonwealth Of Massachusetts Page 6

ADVERTISEMENT

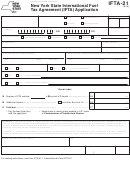

International Fuel Tax Agreement

6

II. Registration

A. Application Requirements

Any motor carrier based in Massachusetts and operating one (1) or more qualified motor vehicles in at least

one (1) other IFTA member jurisdiction must file an IFTA License Application in Massachusetts. Applications

must be filled out completely and typed or printed in ink. Submit the completed application to the Massachu-

setts Department of Revenue, IFTA Operations Unit, PO Box 7027, Boston, MA 02204.

A carrier will not be issued IFTA credentials if its IFTA account is delinquent, or if the carrier was previously

licensed in another IFTA member jurisdiction and the carrier’s license has been suspended or revoked and is

still in that status in that member jurisdiction. The Department of Revenue will not issue a license if the license

application submitted contains misrepresentations, misstatements or omissions of required information.

If a carrier qualifies as an IFTA licensee but does not wish to participate in the IFTA program, trip permits

must be obtained to travel through member jurisdictions in accordance with the regulations of each mem-

ber jurisdiction.

B. IFTA Fees

IFTA licenses and decals are renewed and issued annually. The decals cost $8 per set.

C. IFTA Credentials

1. License

An IFTA license will be issued for each qualified motor vehicle operating in IFTA member jurisdictions. The license

or a photocopy of the IFTA license must be maintained in the cab of each qualified motor vehicle. The IFTA license

is valid for the calendar year January 1 through December 31. If a carrier is found operating a qualified motor

vehicle without an IFTA license, the vehicle operator may be subject to the purchase of a trip permit and a fine.

2. Decals

Two decals will be issued for each qualified motor vehicle operated by the IFTA licensee. IFTA requires that one

decal be placed on the exterior of the passenger’s side of the power unit. The second decal should be placed on

the exterior portion of the driver’s side of the power unit. A licensee may request extra decals for fleet additions.

Decals that are assigned to new owner-operators whose qualified vehicles are under a long-term lease must be

recalled once the lease is terminated. Failure to display the IFTA decals properly may subject the vehicle operator

to the purchase of a trip permit and a fine.

Licensees may request additional decals throughout the license year by completing an application IFTA-1 form.

3. Grace Period

All IFTA carriers shall be allowed a two-month grace period to display the current-year IFTA license and decals. A

carrier must display one of the following to travel through IFTA jurisdictions for the first two months of each year:

a. a valid IFTA license and two IFTA decals from the prior year from the IFTA jurisdiction in which it is based;

b. a single-trip permit from the IFTA jurisdiction in which it is operating; or

c. a valid current-year IFTA license and two IFTA decals from the IFTA jurisdiction in which it is based.

4. Temporary IFTA Permit

This is a permit issued by the base jurisdiction to be carried in a qualified motor vehicle in lieu of the permanent

annual decals. A temporary permit is vehicle-specific and is valid for a period of thirty (30) days to allow the

carrier adequate time to affix the permanent decals. The temporary IFTA permit will be issued only to currently

registered IFTA carriers.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17