North Dakota Office of State Tax Commissioner

Tax Amnesty Application

page 2

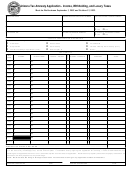

D. Payment Details

Complete the appropriate boxes in columns 1, 2, and 3 that correspond to the type of tax liability for which you are requesting Tax Amnesty. For

a complete listing of tax types, refer to page 3. In column 3, please indicate the total amount that is included in the payment you have enclosed

with this Application.

2.

Amount paid if you are

1.

paying on an Assessment

Amount paid if you

or existing liability.

3.

are filing returns

(Attach most recent copy

Total amount

under Tax Amnesty.

of billing or Notice of

paid with this

Tax Types

(Attach returns.)

Determination.)

Application.

1. Individual Income Tax

1

1

1

2. Corporate Income Tax

2

2

2

3

3

3

3. Sales Tax

4

4

4

4. Use Tax

5. Withholding Tax

5

5

5

6. Other

6

6

6

7. Other

7

7

7

8. Other

8

8

8

Total Amount Enclosed with this Application

$

Need Assistance? If you need help computing your tax liability or want to make arrangements to pay an amount due on or

before Saturday January 31, 2004, call the Tax Department, Monday - Friday, 8:00 AM - 5:00 PM, at 701-328-2775.

E. Certification & Signatures

By signing the Tax Amnesty Application,

I agree to satisfy all of the requirements for Tax Amnesty, and I understand that if all requirements are not satisfied, my request for

amnesty will be denied and approval will be deemed revoked.

I understand that any return filed with the Tax Amnesty application is subject to audit in the same manner as any timely filed tax return.

I declare under N.D.C.C. § 12.1-11-02, which provides for a Class A misdemeanor for making a false statement in a governmental

matter, that this application, and any accompanying schedules and statements, has been examined by me and to the best of my knowledge

and belief is a true, correct, and complete application. Any Tax Amnesty granted may be revoked if it is determined that a false

statement was made.

I understand that if I am requesting Tax Amnesty for any assessments in formal protest or litigation, I waive any right to amend, appeal,

or file a claim for refund unless my tax liability is changed as the result of a federal audit.

I agree to comply with all state tax laws for any return or tax due after June 30, 2003.

Please sign and date this application in the space provided below.

Taxpayer Signature

Date

Spouse Signature

Date

(if applicable)

Tax Department use only

Mail to:

TAX AMNESTY PROGRAM

OFFICE OF STATE TAX COMMISSIONER

PO BOX 4090

BISMARCK, ND 58502-4090

Need more information or assistance?

Call the Office of State Tax Commissioner:

701-328-2775

1

1 2

2