Form Dr-700016 - Florida Communications Services Tax Return - 2002 Page 14

ADVERTISEMENT

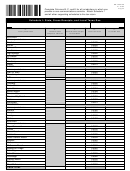

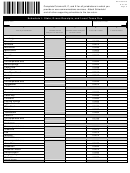

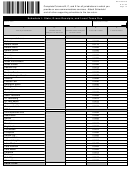

DR-700016S

R. 01/02

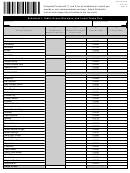

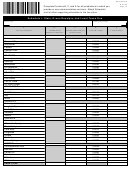

If you complete Schedule I, then you must also complete

Page 15

Summary of Schedule I. Attach the schedule, summary,

and all other supporting schedules to the tax return.

Summary of Schedule I - State, Gross Receipts, and Local Taxes Due

Business name

Business partner number

F.

G.

H.

State Tax

Gross Receipts Tax

Local Tax

1. Taxable sales

4. Taxable sales

7. Local tax due

(Col. B grand

(Col. C grand

(Enter this

total)

total)

amount on

Page 1, Line 3)

2. State tax rate

.068

5. Gross receipts

.0237

tax rate

3. State tax due

6. Gross receipts

(Enter this

tax due

amount on

(Enter this amount

Page 1, Line 1)

on Page 1, Line 2)

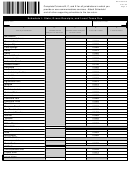

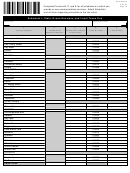

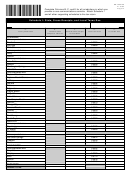

Complete this form, sign it, and mail it with

your DR-700016 if:

The business name (legal entity) changed.

The business was closed.

The business was sold.

To report an address change, submit the

information on the payment coupon (Page 1

of the return).

Closing or Sale of Business or Change of Legal Entity

The legal entity changed on

______/______/______

. If you change your legal entity and are continuing to do business in Florida and the corporation

is registered for communications services tax, you must complete a new Application to Collect and/or Report Tax in Florida (Form DR-1).

The business was closed permanently on

______/______/______

.

Are you a corporation/partnership required to file communications services tax returns?

Yes

No

Business partner

FEIN

number

The business was sold on

______/______/______

. The new owner information is:

Name of new owner:

Telephone number of new owner: (

)

Mailing address of new owner:

City:

County:

State:

ZIP:

Signature of officer (required)

Date

Telephone number (

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17