Form Dr-700016 - Florida Communications Services Tax Return - 2002 Page 2

ADVERTISEMENT

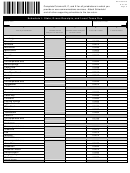

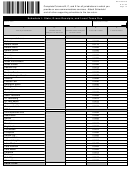

DR-700016S

R. 01/02

Complete Columns B, C, and E for all jurisdictions in which you

Page 3

provide or use communications services. Attach Schedule I

and all other supporting schedules to the tax return.

Schedule I - State, Gross Receipts, and Local Taxes Due

Business name

Business partner number

A.

B.

C.

D.

E.

Local jurisdiction

Taxable sales

Taxable sales subject

Local tax rates

Local tax due

subject to state tax

to local taxes

ALACHUA

Unincorporated area

0.0612

Alachua

0.0470

Archer

0.0602

Gainesville

0.0602

Hawthorne

0.0272

High Springs

0.0602

La Crosse

0.0432

Micanopy

0.0342

Newberry

0.0520

Waldo

0.0212

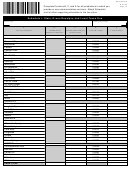

BAKER

Unincorporated area

0.0124

Glen St. Mary

0.0620

Macclenny

0.0702

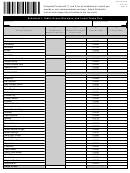

BAY

Unincorporated area

0.0234

Callaway

0.0600

Cedar Grove

0.0582

Lynn Haven

0.0612

Mexico Beach

0.0358

Panama City

0.0612

Panama City Beach

0.0602

Parker

0.0602

Springfield

0.0612

BRADFORD

Unincorporated area

0.0134

Brooker

0.0380

Hampton

0.0300

Lawtey

0.0180

Starke

0.0452

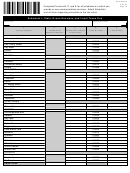

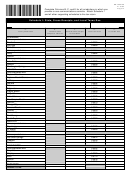

BREVARD

Unincorporated area

0.0166

Cape Canaveral

0.0562

Cocoa

0.0430

Cocoa Beach

0.0562

Indialantic

0.0670

Indian Harbour Beach

0.0534

Malabar

0.0562

Melbourne

0.0572

Melbourne Beach

0.0562

Melbourne Village

0.0562

Palm Bay

0.0562

Palm Shores

0.0520

Rockledge

0.0552

Satellite Beach

0.0532

Titusville

0.0582

West Melbourne

0.0592

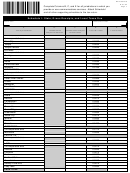

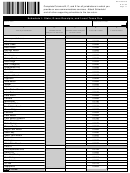

PAGE TOTAL

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17