Form Dr-700016 - Florida Communications Services Tax Return - 2002 Page 5

ADVERTISEMENT

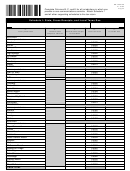

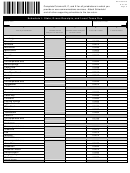

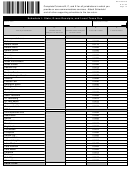

DR-700016S

R. 01/02

Complete Columns B, C, and E for all jurisdictions in which you

Page 6

provide or use communications services. Attach Schedule I

and all other supporting schedules to the tax return.

Schedule I - State, Gross Receipts, and Local Taxes Due

Business name

Business partner number

A.

B.

C.

D.

E.

Local jurisdiction

Taxable sales subject

Local tax rates

Local tax due

Taxable sales

subject to state tax

to local taxes

GADSDEN

Unincorporated area

0.0104

Chattahoochee

0.0582

Greensboro

0.0562

Gretna

0.0602

Havana

0.0572

Midway

0.0450

Quincy

0.0582

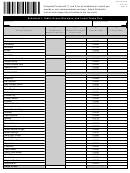

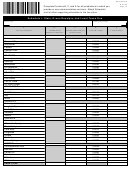

GILCHRIST

Unincorporated area

0.0234

Bell

0.0530

Fanning Springs

0.0662

Trenton

0.0602

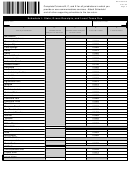

GLADES

Unincorporated area

0.0110

Moore Haven

0.0190

GULF

Unincorporated area

0.0094

Port St. Joe

0.0582

Wewahitchka

0.0582

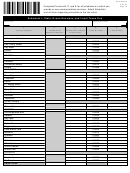

HAMILTON

Unincorporated area

0.0090

Jasper

0.0580

Jennings

0.0570

White Springs

0.0600

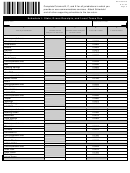

HARDEE

Unincorporated area

0.0194

Bowling Green

0.0390

Wauchula

0.0612

Zolfo Springs

0.0302

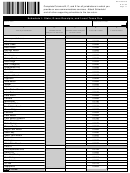

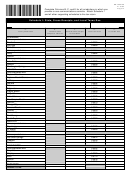

HENDRY

Unincorporated area

0.0244

Clewiston

0.0612

La Belle

0.0512

HERNANDO

Unincorporated area

0.0180

Brooksville

0.0562

Weeki Wachee

0.0040

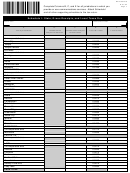

HIGHLANDS

Unincorporated area

0.0244

Avon Park

0.0612

Lake Placid

0.0160

Sebring

0.0582

PAGE TOTAL

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17