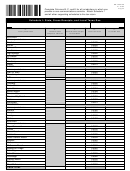

Form Dr-700016 - Florida Communications Services Tax Return - 2002 Page 4

ADVERTISEMENT

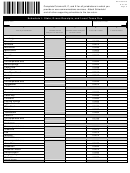

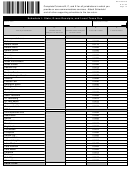

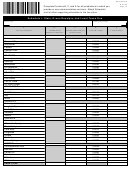

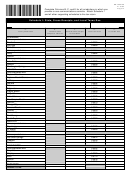

DR-700016S

R. 01/02

Complete Columns B, C, and E for all jurisdictions in which you

Page 5

provide or use communications services. Attach Schedule I

and all other supporting schedules to the tax return.

Schedule I - State, Gross Receipts, and Local Taxes Due

Business name

Business partner number

A.

B.

C.

D.

E.

Local jurisdiction

Taxable sales subject

Local tax rates

Local tax due

Taxable sales

subject to state tax

to local taxes

CLAY

Unincorporated area

0.0702

Green Cove Springs

0.0612

Keystone Heights

0.0302

Orange Park

0.0582

Penney Farms

0.0592

COLLIER

Unincorporated area

0.0230

Everglades

0.0420

Marco Island

0.0542

Naples

0.0360

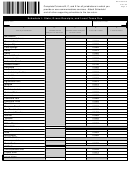

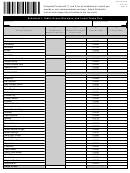

COLUMBIA

Unincorporated area

0.0200

Fort White

0.0130

Lake City

0.0612

DESOTO

Unincorporated area

0.0304

Arcadia

0.0612

DIXIE

Unincorporated area

0.0234

Cross City

0.0320

Horseshoe Beach

0.0720

DUVAL

Atlantic Beach

0.0712

Baldwin

0.0732

Jacksonville Beach

0.0582

Jax Duval

0.0582

Neptune Beach

0.0612

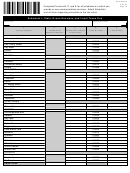

ESCAMBIA

Unincorporated area

0.0284

Century

0.0320

Pensacola

0.0640

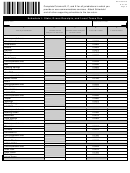

FLAGLER

Unincorporated area

0.0264

Beverly Beach

0.0612

Bunnell

0.0612

Flagler Beach

0.0630

Marineland

0.0110

Palm Coast

0.0602

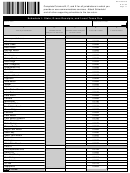

FRANKLIN

Unincorporated area

0.0090

Apalachicola

0.0390

Carrabelle

0.0632

PAGE TOTAL

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17