Form Dr-700016 - Florida Communications Services Tax Return - 2002 Page 9

ADVERTISEMENT

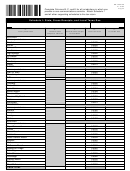

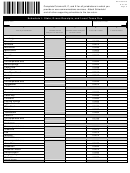

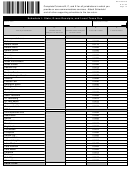

DR-700016S

R. 01/02

Complete Columns B, C, and E for all jurisdictions in which you

Page 10

provide or use communications services. Attach Schedule I

and all other supporting schedules to the tax return.

Schedule I - State, Gross Receipts, and Local Taxes Due

Business name

Business partner number

A.

B.

C.

D.

E.

Local jurisdiction

Taxable sales subject

Local tax rates

Local tax due

Taxable sales

subject to state tax

to local taxes

MONROE

Unincorporated area

0.0264

Islamorada

0.0612

Key Colony Beach

0.0620

Key West

0.0250

Layton

0.0090

Marathon

0.0632

NASSAU

Unincorporated area

0.0254

Callahan

0.0550

Fernandina Beach

0.0612

Hilliard

0.0388

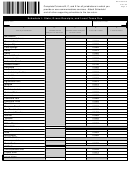

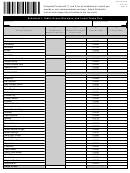

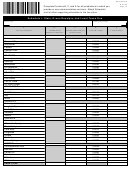

OKALOOSA

Unincorporated area

0.0194

Cinco Bayou

0.0540

Crestview

0.0542

Destin

0.0542

Ft. Walton Beach

0.0602

Laurel Hill

0.0300

Mary Esther

0.0542

Niceville

0.0600

Shalimar

0.0540

Valparaiso

0.0552

OKEECHOBEE

Unincorporated area

0.0150

Okeechobee

0.0594

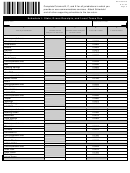

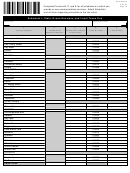

ORANGE

Unincorporated area

0.0520

Apopka

0.0662

Bay Lake

0.0000

Belle Isle

0.0192

Eatonville

0.0562

Edgewood

0.0522

Lake Buena Vista

0.0000

Maitland

0.0572

Oakland

0.0562

Ocoee

0.0562

Orlando

0.0530

Windermere

0.0562

Winter Garden

0.0562

Winter Park

0.0622

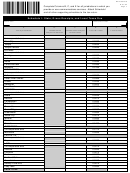

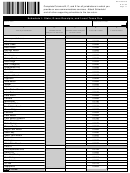

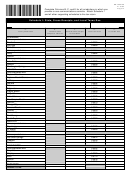

OSCEOLA

Unincorporated area

0.0612

Kissimmee

0.0602

St. Cloud

0.0600

PAGE TOTAL

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17