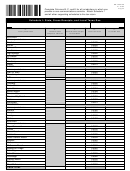

Form Dr-700016 - Florida Communications Services Tax Return - 2002 Page 6

ADVERTISEMENT

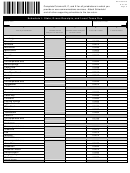

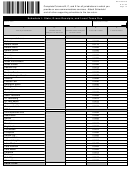

DR-700016S

R. 01/02

Complete Columns B, C, and E for all jurisdictions in which you

Page 7

provide or use communications services. Attach Schedule I

and all other supporting schedules to the tax return.

Schedule I - State, Gross Receipts, and Local Taxes Due

Business name

Business partner number

A.

B.

C.

D.

E.

Local jurisdiction

Taxable sales subject

Local tax rates

Local tax due

Taxable sales

subject to state tax

to local taxes

HILLSBOROUGH

Unincorporated area

0.0280

Plant City

0.0682

Tampa

0.0632

Temple Terrace

0.0640

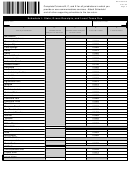

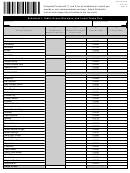

HOLMES

Unincorporated area

0.0080

Bonifay

0.0692

Esto

0.0150

Noma

0.0080

Ponce De Leon

0.0350

Westville

0.0160

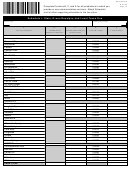

INDIAN RIVER

Unincorporated area

0.0254

Fellsmere

0.0582

Indian River Shores

0.0360

Orchid

0.0290

Sebastian

0.0602

Vero Beach

0.0612

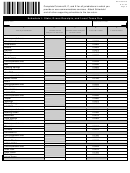

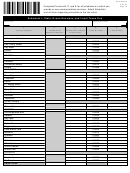

JACKSON

Unincorporated area

0.0254

Alford

0.0220

Bascom

0.0212

Campbellton

0.0592

Cottondale

0.0632

Graceville

0.0632

Grand Ridge

0.0592

Greenwood

0.0592

Jacob City

0.0070

Malone

0.0592

Marianna

0.0622

Sneads

0.0430

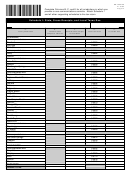

JEFFERSON

Unincorporated area

0.0174

Monticello

0.0540

LAFAYETTE

Unincorporated area

0.0234

Mayo

0.0260

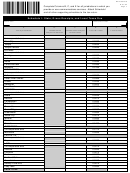

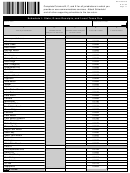

LAKE

Unincorporated area

0.0274

Astatula

0.0540

Clermont

0.0612

Eustis

0.0622

Fruitland Park

0.0622

Groveland

0.0610

Howey-in-the-Hills

0.0612

Lady Lake

0.0592

PAGE TOTAL

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17