Instructions For Schedule Amt Tax

ADVERTISEMENT

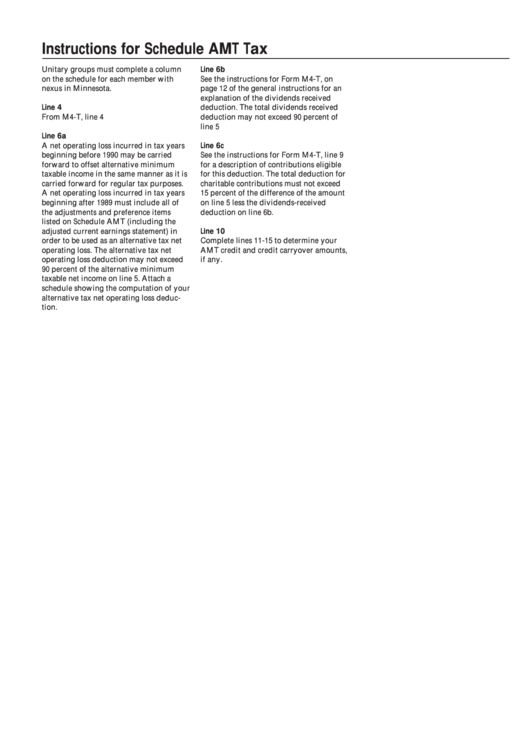

Instructions for Schedule AMT Tax

Line 6b

Unitary groups must complete a column

on the schedule for each member with

See the instructions for Form M4-T, on

nexus in Minnesota.

page 12 of the general instructions for an

explanation of the dividends received

Line 4

deduction. The total dividends received

From M4-T, line 4

deduction may not exceed 90 percent of

line 5

Line 6a

Line 6c

A net operating loss incurred in tax years

beginning before 1990 may be carried

See the instructions for Form M4-T, line 9

forward to offset alternative minimum

for a description of contributions eligible

taxable income in the same manner as it is

for this deduction. The total deduction for

carried forward for regular tax purposes.

charitable contributions must not exceed

A net operating loss incurred in tax years

15 percent of the difference of the amount

beginning after 1989 must include all of

on line 5 less the dividends-received

the adjustments and preference items

deduction on line 6b.

listed on Schedule AMT (including the

Line 10

adjusted current earnings statement) in

order to be used as an alternative tax net

Complete lines 11-15 to determine your

operating loss. The alternative tax net

AMT credit and credit carryover amounts,

operating loss deduction may not exceed

if any.

90 percent of the alternative minimum

taxable net income on line 5. Attach a

schedule showing the computation of your

alternative tax net operating loss deduc-

tion.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1