Publication 971 - Innocent Spouse Relief - Internal Revenue Service Page 11

ADVERTISEMENT

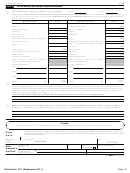

Part IV

3. Janie believes she meets the fourth condition. She

believes it would be unfair to be held liable for the tax

because she did not benefit from the award. Joe

Line 14. Because she was not involved in preparing the

spent it on personal items for his use only.

return, she checks the box, “You were not involved in

preparing the returns.”

Because Janie believes she qualifies for innocent spouse

relief, she first completes Part I of Form 8857 to determine

if she should file the form. In Part I, she makes all entries

Line 15. She checks the box, “You did not know anything

under the Tax Year 1 column because she is requesting

was incorrect or missing” because she did not know that

relief for only one year.

Joe had received a $5,000 award. She explains this in the

space provided.

Part I

Line 16. She checks the box, “You knew that person had

Line 1. She enters “2007” on line 1 because this is the tax

income” because she knew Joe had income from wages.

year for which she is requesting relief.

She also lists Joe’s income. Under “Type of Income” she

Line 2. She checks the box because she wants a refund.

enters “wages.” Under “Who paid it to that person,” she

enters the name of Joe’s employer, “Allied.” Under “Tax

Note. Because the IRS used her individual refund to

Year 1” she enters the amount of Joe’s wages, “$40,000.”

pay the tax owed on the joint tax return, she does not need

Because she is only requesting relief for one tax year, she

to provide proof of payment.

leaves the entry spaces for “Tax Year 2” and “Tax Year 3”

blank.

Line 3. She checks the “No” box because the IRS did not

use her share of a joint refund to pay Joe’s past-due debts.

Line 17. She checks the “No” box because she did not

know any amount was owed to the IRS when the 2007

Line 4. She checks the “Yes” box because she filed a joint

return was signed.

tax return for tax year 2007.

Line 5. She skips this line because she checked the “Yes”

Line 18. She checks the “No” box because, when the

box on line 4.

return was signed, she was not having financial problems.

Part II

Line 19. She checks the box, “You were not involved in

handling money for the household” because Joe handled

Line 6. She enters her name, address, social security

all the money for the household. She provides additional

number, county, and best daytime phone number.

information in the space provided.

Part III

Line 20. She checks the “No” box because Joe has never

Line 7. She enters Joe’s name, address, social security

transferred money or property to her.

number, and best daytime phone number.

Part V

Line 8. She checks the “divorced since” box and enters

the date she was divorced as “05/13/2009.” She attaches a

Line 21. She enters the number “1” on both the line for

copy of her entire divorce decree (not Illustrated) to the

form.

“Adults” and the line for “Children” because her current

household consists of herself and her son.

Line 9. She checks the box for “High school diploma,

equivalent, or less,” because she had completed high

Line 22. She enters her average monthly income for her

school when her 2007 joint tax return was filed.

entire household.

Line 10. She checks the “No” box because she was not a

Line 23. She lists her assets, which are $500 for the fair

victim of spousal abuse or domestic violence.

market value of a car, $450 in her checking account, and

Line 11. She checks the “No” box because neither she nor

$100 in her savings account.

Joe incurred any large expenses during the year for which

she wants relief.

Signing and mailing Form 8857. Janie signs and dates

the form. She attaches the copy of her divorce decree (not

Line 12. She checks the “Yes” box because she signed

illustrated) required by line 8. Finally, she sends the form to

the 2007 joint tax return.

the IRS address or fax number shown in the instructions

for Form 8857.

Line 13. She checks the “No” box because she did not

have a mental or physical condition when the return was

filed and does not have one now.

Publication 971 (September 2011)

Page 11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24