Publication 971 - Innocent Spouse Relief - Internal Revenue Service Page 13

ADVERTISEMENT

2

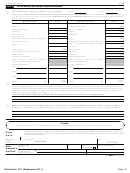

Form 8857 (Rev. 9-2010)

Page

Note. If you need more room to write your answer for any question, attach more pages. Be sure to write your name and social security

number on the top of all pages you attach.

(Continued)

Part III

8

What is the current marital status between you and the person on line 7?

Married and still living together

Married and living apart since

MM

DD

YYYY

Widowed since

Attach a photocopy of the death certificate and will (if one exists).

MM

DD

YYYY

Legally separated since

Attach a photocopy of your entire separation agreement.

MM

DD

YYYY

√

05-13-2009

Divorced since

Attach a photocopy of your entire divorce decree.

MM

DD

YYYY

Note. A divorce decree stating that your former spouse must pay all taxes does not necessarily mean you qualify for relief.

What was the highest level of education you had completed when the return(s) were filed? If the answers are not the same for all

9

tax years, explain.

√

High school diploma, equivalent, or less

Some college

College degree or higher. List any degrees you have

List any college-level business or tax-related courses you completed

Explain

Were you a victim of spousal abuse or domestic violence during any of the tax years you want relief? If the answers are not the

10

same for all tax years, explain.

Yes. Attach a statement to explain the situation and when it started. Provide photocopies of any documentation, such as police

reports, a restraining order, a doctor’s report or letter, or a notarized statement from someone who was aware of the situation.

√

No.

Did you (or the person on line 7) incur any large expenses, such as trips, home improvements, or private schooling, or make

11

any large purchases, such as automobiles, appliances, or jewelry, during any of the years you want relief or any later years?

Yes. Attach a statement describing (a) the types and amounts of the expenses and purchases and (b) the years they were

incurred or made.

√

No.

12

Did you sign the return(s)? If the answers are not the same for all tax years, explain.

√

Yes. If you were forced to sign under duress (threat of harm or other form of coercion), check here

. See instructions.

No. Your signature was forged. See instructions.

When any of the returns were signed, did you have a mental or physical health problem or do you have a mental or physical

13

health problem now? If the answers are not the same for all tax years, explain.

Yes. Attach a statement to explain the problem and when it started. Provide photocopies of any documentation, such as

medical bills or a doctor’s report or letter.

√

No.

Part IV

Tell us how you were involved with finances and preparing returns for those tax years

How were you involved with preparing the returns? Check all that apply and explain, if necessary. If the answers are not the same

14

for all tax years, explain.

You filled out or helped fill out the returns.

You gathered receipts and cancelled checks.

You gave tax documents (such as Forms W-2, 1099, etc.) to the person who prepared the returns.

You reviewed the returns before they were signed.

You did not review the returns before they were signed. Explain below.

√

You were not involved in preparing the returns.

Other

Explain how you were involved

8857

Form

(Rev. 9-2010)

Publication 971 (September 2011)

Page 13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24