Publication 971 - Innocent Spouse Relief - Internal Revenue Service Page 16

ADVERTISEMENT

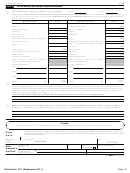

Flowcharts

The following flowcharts provide a quick way for determin-

ing whether you may qualify for relief. But do not rely on

these flowcharts alone. Also read the earlier discussions.

Figure A. Do You Qualify for Innocent Spouse Relief?

Start Here

You do not qualify for innocent

spouse relief but you may qualify for

No

Did you file a joint return for the year you want

relief from liability arising from

relief?

community property law. See

Community Property Laws earlier.

Yes

You do not qualify for innocent

Will you file Form 8857 no later than 2 years

No

spouse relief but you may qualify for

after the first IRS attempt to collect the tax

equitable relief. See Figure C later.

?

1

from you that occurs after July 22, 1998

Yes

No

Does your joint return have an understated tax

due to erroneous items of your spouse?

Yes

2

Yes

At the time you signed the joint return, did you

know or have reason to know that there was an

understated tax?

No

No

Are you able to show, based on the facts and

circumstances, that it would be unfair to hold

you liable for the understated tax?

Yes

You do not qualify for innocent spouse relief; go

to Figure B.

You may qualify for innocent spouse relief.

1

Collection activities that may start the 2-year period are described earlier under How To Request Relief.

2

You may qualify for partial relief if, at the time you filed your return, you knew or had reason to know of only a portion of an erroneous item.

Page 16

Publication 971 (September 2011)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24