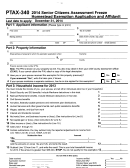

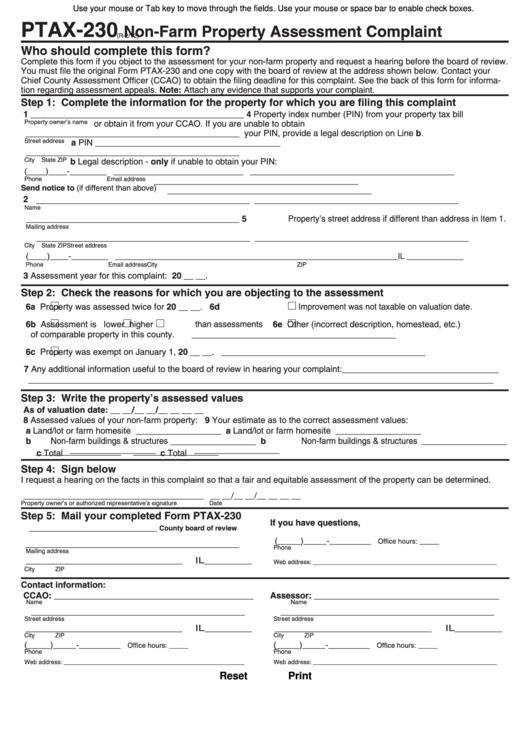

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

PTAX-230

Non-Farm Property Assessment Complaint

(R-2/12)

Who should complete this form?

Complete this form if you object to the assessment for your non-farm property and request a hearing before the board of review.

You must file the original Form PTAX-230 and one copy with the board of review at the address shown below. Contact your

Chief County Assessment Officer (CCAO) to obtain the filing deadline for this complaint. See the back of this form for informa-

tion regarding assessment appeals. Note: Attach any evidence that supports your complaint.

Step 1: Complete the information for the property for which you are filing this complaint

1 _____________________________________________

Property index number (PIN) from your property tax bill

4

Property owner’s name

or obtain it from your CCAO. If you are unable to obtain

your PIN, provide a legal description on Line b.

_____________________________________________

Street address

a PIN _______________________________________

_____________________________________________

City

State

ZIP

b Legal description - only if unable to obtain your PIN:

___________________________________________

(____)____-________ ____________________________

Phone

Email address

___________________________________________

Send notice to (if different than above)

___________________________________________

2 _____________________________________________

___________________________________________

Name

_____________________________________________

5 Property’s street address if different than address in Item 1.

Mailing address

_____________________________________________

_____________________________________________

City

State

ZIP

Street address

(____)____-________ ____________________________

___________________________________IL _____________

Phone

Email address

City

ZIP

3 Assessment year for this complaint: 20 __ __.

Step 2: Check the reasons for which you are objecting to the assessment

6a

Property was assessed twice for 20 __ __.

6d

Improvement was not taxable on valuation date.

6b

6e

Assessment is

lower

higher than assessments

Other (incorrect description, homestead, etc.)

of comparable property in this county.

___________________________________________

6c

Property was exempt on January 1, 20 __ __.

___________________________________________

7 Any additional information useful to the board of review in hearing your complaint:_________________________________

__________________________________________________________________________________________________

Step 3: Write the property’s assessed values

As of valuation date: __ __/__ __/__ __ __ __

8 Assessed values of your non-farm property:

9 Your estimate as to the correct assessment values:

a

a Land/lot or farm homesite

Land/lot or farm homesite

__________________

__________________

b Non-farm buildings & structures __________________

b Non-farm buildings & structures __________________

Total

_ _________________

c Total

_ _________________

_ _________________

_ _________________

c

Step 4: Sign below

I request a hearing on the facts in this complaint so that a fair and equitable assessment of the property can be determined.

_______________________________________ __ __/__ __/__ __ __ __

Property owner’s or authorized representative’s signature

Date

Step 5: Mail your completed Form PTAX-230

If you have questions,

___________________________

County board of review

(_____)_____-_________

Office hours: _____a.m. to _____p.m.

_____________________________________________

Phone

Mailing address

_________________________________IL__________

Web address: ______________________________________________________

City

ZIP

Contact information:

C CAO: __________________________________________

Assessor: _______________________________________

Name

Name

_____________________________________________

_____________________________________________

Street address

Street address

_________________________________IL__________

_________________________________IL__________

City

ZIP

City

ZIP

(_____)_____-_________

(_____)_____-_________

Office hours: _____a.m. to _____p.m.

Office hours: _____a.m. to _____p.m.

Phone

Phone

Web address: _____________________________________________________

Web address: ______________________________________________________

Reset

Print

1

1 2

2