Publication 510 - Excise Taxes - 2004 Page 12

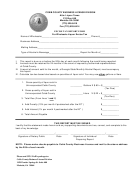

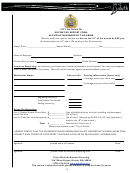

ADVERTISEMENT

Diesel Fuel and Kerosene

that is subject to the rules on failure to blend,

sale. A copy of the registrant’s letter of registra-

discussed later.

tion cannot be used as a gasohol blender’s cer-

tificate. A model certificate is shown in Appendix

Generally, diesel fuel and kerosene are taxed in

Batches containing at least 7.55% alcohol.

B as Model Certificate E. Your certificate must

the same manner as gasoline (discussed ear-

If a mixture contains at least 7.55% but less than

contain all information necessary to complete

lier). The following discussion provides informa-

7.7% alcohol, part of the mixture is considered to

the model.

tion about the excise tax on diesel fuel and

be 7.7% gasohol. To figure that part, multiply the

A certificate expires on the earliest of the

kerosene.

number of gallons of alcohol in the mixture by

following dates.

12.987. The other part of the mixture is excess

Diesel fuel means any liquid that, without fur-

•

liquid subject to the rules on failure to blend,

The date 1 year after the effective date

ther processing or blending, is suitable for use

discussed later.

(which may be no earlier than the date

as a fuel in a diesel-powered highway vehicle or

signed) of the certificate.

train. A liquid is suitable for this use if the liquid

Batches containing at least 5.59% alcohol.

•

If a mixture contains at least 5.59% but less than

has practical and commercial fitness for use in

The date a new certificate is provided to

5.7% alcohol, part of the mixture is considered to

the propulsion engine of a diesel-powered high-

the seller.

be 5.7% gasohol. To figure that part, multiply the

way vehicle or diesel-powered train. A liquid

•

The date the seller is notified the gasohol

number of gallons of alcohol in the mixture by

may possess this practical and commercial fit-

blender’s registration has been revoked or

17.544. The other part of the mixture is excess

ness even though the specified use is not the

suspended.

1

liquid

s predominant use. However, a liquid

liquid that is subject to the rules on failure to

does not possess this practical and commercial

blend, discussed later.

The buyer must provide a new certificate if any

fitness solely by reason of its possible or rare

information on a certificate has changed.

Gasohol blender. A gasohol blender is any

use as a fuel in the propulsion engine of a

person that regularly produces gasohol outside

diesel-powered highway vehicle or diesel-pow-

Tax on gasohol. The tax on the removal or

of the bulk transfer/terminal system for sale or

ered train. Diesel fuel does not include gasoline,

entry of gasohol depends on the type of gasohol.

use in its trade or business. A “registered gaso-

The rates for gasohol containing ethanol are

kerosene, excluded liquid, No. 5 and No. 6 fuel

hol blender” is a person that has been registered

oils covered by ASTM specification D 396, or

shown on Form 720. The rates for gasohol con-

by the IRS as a gasohol blender. See Registra-

F-76 (Fuel Naval Distillate) covered by military

taining methanol are shown in the instructions

tion Requirements, earlier.

specification MIL-F-16884.

for Form 720.

An excluded liquid is either of the following.

Later separation. If a person separates gaso-

Tax Rates

line from gasohol on which a reduced tax rate

1) A liquid that contains less than 4% normal

was imposed, that person is treated as the re-

paraffins.

The tax rate depends on the type of gasohol.

finer of the gasoline. Tax is imposed on the

2) A liquid with all the following properties.

These rates are less than the regular tax rate for

removal or sale of the gasoline. This tax rate is

gasoline. The reduced rate also depends on

the difference between the regular tax rate for

a) Distillation range of 125 degrees Fahr-

whether you are liable for the tax on the removal

gasoline and the tax rate imposed on the prior

enheit or less.

or entry of gasoline used to make gasohol, or on

removal or entry of the gasohol. The person that

b) Sulfur content of 10 ppm or less.

the removal or entry of gasohol. You may be

owns the gasohol when the gasoline is sepa-

liable for additional tax if you later separate the

rated is liable for the tax.

c) Minimum color of +27 Saybolt.

gasoline from the gasohol or fail to blend gaso-

Failure to blend. Tax is imposed on the re-

line into gasohol.

moval, entry, or sale of gasoline on which a

Kerosene. This means any of the following

reduced rate of tax was imposed if the gasoline

Tax on gasoline. The tax on gasoline re-

liquids.

was not blended into gasohol, or was blended

moved or entered for the production of gasohol

•

One of the two grades of kerosene (No.

into gasohol taxable at a higher rate. This tax is

depends on the type of gasohol that is to be

1-K and No. 2-K) covered by ASTM speci-

the difference between the tax that should have

produced. The rates apply to the tax imposed on

fication D 3699.

applied and the tax actually imposed. If the gas-

the removal at the terminal rack or from the

•

oline was not sold, the person liable for this tax is

refinery, or on the nonbulk entry into the United

Aviation-grade kerosene.

the person that was liable for the tax on the entry

States (as discussed under Gasoline, earlier).

or removal. If the gasoline was sold, the person

The rates for gasoline used to produce gasohol

However, kerosene does not include ex-

that bought the gasoline in connection with the

containing ethanol are shown on Form 720. The

cluded liquid, discussed earlier.

taxable removal or entry is liable for this tax.

rates for gasoline used to produce gasohol con-

Kerosene also includes any liquid that would

taining methanol are shown in the instructions

be described above but for the presence of a

Example. John uses an empty 8,000 gallon

for Form 720.

dye of the type used to dye kerosene for a

tank to blend gasoline and alcohol. The delivery

nontaxable use.

Requirements. The reduced rates apply if

tickets show he blended 7,205 metered gallons

the person liable for the tax (position holder,

of gasoline and 795 metered gallons of alcohol.

A v i a t i o n - g r a d e

k e r o s e n e .

T h i s

i s

refiner, or enterer) is a registrant and:

He bought the gasoline at a reduced tax rate of

kerosene-type jet fuel covered by ASTM specifi-

14.666 cents per gallon. The batch contains

cation D 1655 or military specification

1) A registered gasohol blender that pro-

9.9375% alcohol (795 ÷ 8,000). John deter-

MIL-DTL-5624T (Grade JP-5) or MIL-DTL-

duces gasohol with the gasoline within 24

mines that 7,950 gallons (10 × 795) of the mix-

83133E (Grade JP-8).

hours after removing or entering the gaso-

ture qualifies as 10% gasohol. See Batches

line, or

Diesel-powered highway vehicle. This is

containing at least 9.8% alcohol, earlier. The

any self-propelled vehicle designed to carry a

2) That person, at the time that the gasoline

other 50 gallons is excess liquid that he failed to

load over public highways (whether or not also

is sold in connection with the removal or

blend into gasohol. He is liable for a tax of 3.734

cents per gallon (18.40 (full rate) − 14.666 (re-

designed to perform other functions) and pro-

entry:

pelled by a diesel-powered engine. Generally,

duced rate)) on this excess liquid.

a) Has an unexpired certificate from the

do not consider as diesel-powered highway ve-

buyer, and

hicles specially designed mobile machinery for

Credits or Refunds

nontransportation functions and vehicles spe-

b) Has no reason to believe any informa-

cially designed for off-highway transportation.

tion in the certificate is false.

A credit or refund for part of the gasoline tax may

For more information about these vehicles and

be allowed if gasoline taxed at the full rate is

for information about vehicles not considered

Certificate. The certificate from the buyer

used to produce gasohol for sale or use in a

highway vehicles, see Publication 378.

certifies that the gasoline will be used by the

person’s trade or business. By signing the claim,

buyer to produce gasohol within 24 hours after

the person certifies that it has, for each batch of

Diesel-powered train. This is any diesel-pow-

purchase. The certificate may be included as

gasohol, the required information related to the

ered equipment or machinery that rides on rails.

part of any business records normally used for a

purchase of the gasoline.

The term includes a locomotive, work train,

Page 12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48