Publication 510 - Excise Taxes - 2004 Page 8

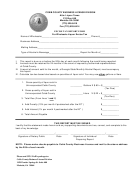

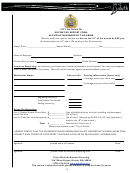

ADVERTISEMENT

Entry. Taxable fuel is entered into the United

if the facility is operated by a registrant and all

Fuel Taxes

States when it is brought into the United States

such taxable fuel stored at the facility has been

and applicable customs law requires that it be

previously taxed upon removal from a refinery or

entered for consumption, use, or warehousing.

terminal.

Excise taxes are imposed on all the following

This does not apply to fuel brought into Puerto

fuels.

Terminal operator. This is any person that

Rico (which is part of the U.S. customs territory),

•

owns, operates, or otherwise controls a termi-

Gasoline.

but does apply to fuel brought into the United

nal.

•

States from Puerto Rico.

Gasohol.

•

Throughputter. This is any person that is a

Measurement of taxable fuel. Volumes of

Diesel fuel.

position holder or that owns taxable fuel within

taxable fuel can be measured on the basis of

•

Kerosene.

the bulk transfer/terminal system (other than in a

actual volumetric gallons or gallons adjusted to

•

terminal).

60 degrees Fahrenheit.

Aviation fuel.

•

Pipeline operator. This is the person that op-

Vessel operator. This is the person that oper-

Special motor fuels (including LPG).

ates a vessel within the bulk transfer/terminal

erates a pipeline within the bulk transfer/terminal

•

Compressed natural gas.

system. However, vessel does not include a

system.

•

deep draft ocean-going vessel.

Fuels used in commercial transportation

Position holder. This is the person that holds

on inland waterways.

the inventory position in the taxable fuel in the

Information Returns

terminal, as reflected in the records of the termi-

nal operator. You hold the inventory position

Definitions

Form 720 – TO and Form 720 – CS are informa-

when you have a contractual agreement with the

tion returns used to report monthly receipts and

terminal operator for the use of the storage facili-

The following terms are used throughout the

disbursements of liquid products. A liquid prod-

ties and terminaling services for the taxable fuel.

discussion of fuel taxes. Other terms are defined

uct is any liquid transported into storage at a

A terminal operator that owns taxable fuel in its

in the discussion of the specific fuels to which

terminal or delivered out of a terminal. For a list

terminal is a position holder.

they pertain.

of products, see the product code table in the

Rack. This is a mechanism capable of deliver-

Instructions for Forms 720-TO and 720-CS.

Approved terminal or refinery. This is a ter-

ing fuel into a means of transport other than a

The returns are due the last day of the month

minal operated by a registrant that is a terminal

pipeline or vessel.

following the month in which the transaction

operator or a refinery operated by a registrant

occurs. These returns can be filed on paper or

that is a refiner.

Refiner. This is any person that owns, oper-

electronically. For information on filing electroni-

ates, or otherwise controls a refinery.

cally, see Publication 3536, Motor Fuel Excise

Biodiesel. This is a liquid composed of

Refinery. This is a facility used to produce

Tax EDI Guide.

monoalkyl esters of long chain fatty acids de-

taxable fuel and from which taxable fuel may be

rived from vegetable oils or animal fats that is

Form 720-TO. This information return is used

removed by pipeline, by vessel, or at a rack.

covered by ASTM specification D 6751.

by terminal operators to report receipts and dis-

However, this term does not include a facility

Biodiesel does not contain any paraffins.

bursements of all liquid products to and from all

where only blended fuel or gasohol, and no

approved terminals. Each terminal operator

Blended taxable fuel. This means any tax-

other type of fuel, is produced. For this purpose,

must file a separate form for each approved

able fuel produced outside the bulk transfer/

blended fuel is any mixture that would be

terminal.

terminal system by mixing taxable fuel on which

blended taxable fuel if produced outside the bulk

excise tax has been imposed and any other

transfer/terminal system.

Form 720-CS. This information return must be

liquid on which excise tax has not been im-

filed by bulk transport carriers (barges, vessels,

Registrant. This is a taxable fuel registrant

posed. This does not include a mixture removed

and pipelines) who receive liquid product from

(see Registration Requirements, later).

or sold during the calendar quarter if all such

an approved terminal or deliver liquid product to

mixtures removed or sold by the blender contain

Removal. This is any physical transfer of tax-

an approved terminal.

less than 400 gallons of a liquid on which the tax

able fuel. It also means any use of taxable fuel

has not been imposed. Blended taxable fuel

other than as a material in the production of

Registration Requirements

does not include gasohol that receives an excise

taxable or special fuels. However, taxable fuel is

tax benefit.

not removed when it evaporates or is otherwise

The following discussion applies to excise tax

lost or destroyed.

registration requirements for activities relating to

Blender. This is the person that produces

fuels only. See Form 637 for other persons who

Sale. For taxable fuel not in a terminal, this is

blended taxable fuel. However, if an untaxed

the transfer of title to, or substantial incidents of

must register and for more information about

liquid is sold as taxed taxable fuel and that

registration.

ownership in, taxable fuel to the buyer for

untaxed liquid is used to produce blended tax-

money, services, or other property. For taxable

able fuel, the person that sold the untaxed liquid

Persons that must register. You must be

fuel in a terminal, this is the transfer of the

is jointly and severally liable for the tax imposed

registered if you are any of the following per-

inventory position if the transferee becomes the

on the blender’s sale or removal of the blended

sons.

position holder for that taxable fuel.

taxable fuel.

•

A blender.

State. This includes any state, any of its politi-

Bulk transfer. This is the transfer of taxable

•

cal subdivisions, the District of Columbia, and

An enterer.

fuel by pipeline or vessel.

the American Red Cross. An Indian tribal gov-

•

A pipeline operator.

ernment is treated as a state only if transactions

Bulk transfer/terminal system. This is the

•

involve the exercise of an essential tribal gov-

A position holder.

taxable fuel distribution system consisting of re-

ernment function.

•

fineries, pipelines, vessels, and terminals. Fuel

A refiner.

in the supply tank of any engine, or in any tank

Taxable fuel. This means gasoline, diesel

•

A terminal operator.

car, railcar, trailer, truck, or other equipment

fuel, or kerosene.

•

suitable for ground transportation is not in the

A vessel operator.

Terminal. This is a storage and distribution

bulk transfer/terminal system.

facility supplied by pipeline or vessel, and from

In addition, bus and train operators must be

Enterer. This is the importer of record for the

which taxable fuel may be removed at a rack. It

registered if they use dyed diesel fuel in their

taxable fuel. However, if the importer of record is

does not include a facility at which gasoline

buses or trains and they incur liability for tax at

acting as an agent, such as a customs broker,

blendstocks are used in the manufacture of

the bus or train rate.

the person for whom the agent is acting is the

products other than finished gasoline if no gaso-

enterer. If there is no importer of record, the

line is removed from the facility. A terminal does

Persons that may register. You may, but are

owner at the time of entry into the United States

not include any facility where finished gasoline,

not required to, register if you are any of the

is the enterer.

undyed diesel fuel, or undyed kerosene is stored

following persons.

Page 8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48