Publication 510 - Excise Taxes - 2004 Page 38

ADVERTISEMENT

Appendix B

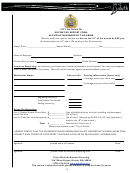

This appendix contains models of the certificates, reports, and statements discussed earlier under Fuel Taxes.

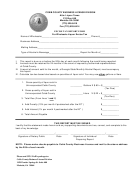

Model Certificate A

FIRST TAXPAYER’S REPORT

1.

First Taxpayer’s name, address, and employer identification number

2.

Name, address, and employer identification number of the buyer of the taxable fuel subject to tax

3.

Date and location of removal, entry, or sale

4.

Volume and type of taxable fuel removed, entered, or sold

5.

Check type of taxable event:

Removal from refinery

Entry into United States

Bulk transfer from terminal by unregistered position holder

Bulk transfer not received at an approved terminal

Sale within the bulk transfer/terminal system

Removal at the terminal rack

Removal or sale by the blender

6.

Amount of federal excise tax paid on account of the removal, entry, or sale

The undersigned taxpayer (“Taxpayer”) has not received, and will not claim, a credit with respect to, or a refund of, the tax on the

taxable fuel to which this form relates.

Under penalties of perjury, Taxpayer declares that Taxpayer has examined this statement, including any accompanying schedules and

statements, and, to the best of Taxpayer’s knowledge and belief, they are true, correct and complete.

Signature and date signed

Printed or typed name of person signing this report

Title

Page 38

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48