Publication 510 - Excise Taxes - 2004 Page 28

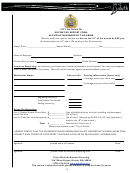

ADVERTISEMENT

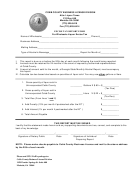

Special rule for deposits of taxes in Septem-

One-time filing. See the Instructions for

book for additional information. If you do not

Form 720 for information on eligibility to make a

have a coupon book, call 1-800-829-4933.

ber 2004. If you are required to make depos-

one-time filing of Form 720 for the gas guzzler

its, see the chart below. The special rule does

Beginning in January 2004, you will

tax.

not apply to taxes not required to be deposited

TIP

automatically be enrolled in EFTPS

(see Payment of Taxes above). See Regula-

when you apply for an EIN. You will

Payment voucher. Form 720-V, Payment

tions section 40.6302(c)-2 for rules to figure the

receive a separate mailing containing instruc-

Voucher, must be included with Form 720 and

net tax liability for the deposits due in Septem-

tions for activating your EFTPS enrollment after

your payment if you have a balance due on

ber.

you receive your EIN. You will still have the

line 10 of Form 720.

option to use FTD coupons, but see Electronic

Additional deposit of taxes in September

deposit requirement above.

2004

Payment of Taxes

When To Make Deposits

For the Period

Beginning Ending Due

There are two methods for determining depos-

Generally, semimonthly deposits of excise taxes

Type of Tax

on

on

Date

its: the regular method and the alternative

are required. A semimonthly period is the first

Regular method

method.

15 days of a month (the first semimonthly pe-

taxes

The regular method applies to all taxes in

riod) or the 16th through the last day of a month

1

EFTPS

Sept. 16

Sept.

Sept.

Part I of Form 720 except for communications

(the second semimonthly period).

26

29

and air transportation taxes if deposits are

However, no deposit is required for the situa-

Non-EFTPS

Sept. 16

Sept.

Sept.

based on amounts billed or tickets sold, rather

tions listed below; the taxes are payable with

25

28

than on amounts actually collected. See Alter-

Form 720.

native method below.

Alternative method

•

The net liability for taxes listed in Part I

If you are depositing more than one tax

taxes (IRS Nos. 22,

(Form 720) does not exceed $2,500 for

under a method, combine all the taxes under the

26, 27, and 28)

the quarter.

(based on amounts

method and make one deposit for the semi-

•

billed)

monthly period.

The gas guzzler tax is being paid on a

EFTPS

1

Sept. 1

Sept.

Sept.

one-time filing.

Regular method. The deposit of tax for a

11

29

•

The liability is for taxes listed in Part II

semimonthly period is due by the 14th day fol-

Non-EFTPS

Sept. 1

Sept.

Sept.

(Form 720), except for the floor stocks tax,

10

28

lowing that period. Generally, this is the 29th day

that generally requires a single deposit.

of a month for the first semimonthly period and

1

See Electronic deposit requirement above.

•

the 14th day of the following month for the sec-

The tax liability is for the removal of a

ond semimonthly period. If the 14th or the 29th

batch of gasohol from an approved refin-

day falls on a Saturday, Sunday, or legal holi-

ery by bulk transfer, if the refiner elects to

Amount of Deposits

day, you must make the deposit by the immedi-

treat itself for that removal as not regis-

ately preceding day that is not a Saturday,

tered under section 4101. See Regula-

Deposits for a semimonthly period generally

Sunday, or legal holiday.

tions section 48.4081-3.

must be at least 95 percent of the net tax liability

for that period unless the safe harbor rule (dis-

Alternative method (IRS Nos. 22, 26, 27, and

How To Make Deposits

cussed later) applies. Generally, you do not

28). Deposits of communications and air

have to make a deposit for a period in which you

transportation taxes may be based on taxes

To avoid a penalty, make your deposits timely

incurred no tax liability.

included in amounts billed or tickets sold during

and do not mail your deposits directly to the IRS.

a semimonthly period instead of on taxes actu-

Records of your deposits will be sent to the IRS

ally collected during the period. Under the alter-

Net tax liability. Your net tax liability is your

for crediting to your accounts.

native method, the tax included in amounts

tax liability for the period minus any claims on

billed or tickets sold during a semimonthly pe-

Schedule C (Form 720) for the period. You may

Electronic deposit requirement. You must

riod is considered collected during the first 7

figure your net tax liability for a semimonthly

make electronic deposits of all depository taxes

days of the second following semimonthly pe-

period by dividing your net liability incurred dur-

(such as deposits for employment tax, excise

riod. The deposit of tax is due by the 3rd banking

ing the calendar month by two. If you use this

tax, and corporate income tax) using the Elec-

day after the 7th day of that period.

method, you must use it for all semimonthly

tronic Federal Tax Payment System (EFTPS) in

periods in the calendar quarter.

Example. The tax included in amounts

2004 if:

billed or tickets sold for the period June 16-30,

•

Do not reduce your liability by any

The total deposits of such taxes in 2002

!

2004, is considered collected from July 16-22,

amounts from Form 720X.

exceeded $200,000 or

2004, and must be deposited by July 27, 2004.

CAUTION

•

To use the alternative method, you must

You were required to use EFTPS in 2003.

keep a separate account of the tax included in

amounts billed or tickets sold during the month

If you are required to use EFTPS and use

and report on Form 720 the tax included in

Form 8109, Federal Tax Deposit Coupon, in-

Safe Harbor Rule

amounts billed or tickets sold and not the

stead, you may be subject to a 10% penalty. If

amount of tax that is actually collected. For ex-

you are not required to use EFTPS, you may

The safe harbor rule applies separately to de-

ample, amounts billed in December, January,

participate voluntarily. To get more information

posits under the regular method and the alterna-

and February are considered collected during

or to enroll in EFTPS, call 1-800-555-4477 or

tive method. Persons who filed Form 720 for the

January, February, and March and are reported

1-800-945-8400; or visit the EFTPS website at

look-back quarter (the 2nd calendar quarter pre-

on Form 720 as the tax for the 1st quarter of the

Also see Publication 966,

ceding the current quarter) are considered to

calendar year.

Electronic Choices for Paying ALL Your Federal

meet the semimonthly deposit requirement if the

The net amount of tax that is considered

Taxes.

deposit for each semimonthly period in the cur-

collected during the semimonthly period must be

Depositing on time. For EFTPS deposits to

rent quarter is at least

/

(16.67%) of the net tax

1

6

either:

be on time, you must initiate the transaction at

liability reported for the look-back quarter.

•

least one business day before the date the de-

The net amount of tax reflected in the sep-

For the semimonthly period for which the

posit is due.

arate account for the corresponding semi-

additional deposit is required, the additional de-

monthly period of the preceding month or

posit must be at least

11

/

(12.23%),

10

/

Federal Tax Deposit Coupons. If you are not

90

90

•

(11.12%) for non-EFTPS, of the net tax liability

making deposits by EFTPS, use Form 8109 to

One-half of the net amount of tax reflected

make the deposits at an authorized financial

in the separate account for the preceding

reported for the look-back quarter. Also, the total

institution. See the instructions in the coupon

month.

deposit for that semimonthly period must be at

Page 28

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48