Fourth Quarter 1999 Index Of Charts - Office Of Thrift Supervision - U.s. Department Of Treasury Page 11

ADVERTISEMENT

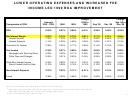

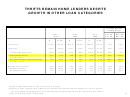

THRIFTS REMAIN HOME LENDERS DESPITE

GROWTH IN OTHER LOAN CATEGORIES

Average Annual

Growth Rates

Dec '93

Dec '98

Dec

Dec

Dec

Dec '99

Dec '99

1993

1998

1999

$

% TA

$

% TA

$

% TA

Total Assets

$774.8

100.0%

$817.6

100.0%

$863.4

100.0%

1.9%

5.6%

Total Loans

503.8

65.0%

555.1

67.9%

583.6

67.6%

2.6%

5.1%

1-4 Family Mortgage Loans

354.8

45.8%

400.9

49.0%

408.0

47.3%

2.5%

1.8%

Construction Loans

12.7

1.6%

13.8

1.7%

17.6

2.0%

6.4%

27.6%

Other Mortgages

95.7

12.4%

77.5

9.5%

81.4

9.4%

-2.5%

5.1%

5.2

0.7%

15.6

1.9%

20.3

2.4%

48.5%

30.6%

Commercial Loans / Small Business

Consumer Loans

35.4

4.6%

47.4

5.8%

56.3

6.5%

9.9%

18.9%

Mortgage Pool Securities

119.5

15.4%

93.3

11.4%

94.8

11.0%

-3.5%

1.6%

Investment Securities

108.6

14.0%

113.8

13.9%

124.3

14.4%

2.4%

9.3%

Mortgage Derivatives

43.8

5.7%

67.1

8.2%

78.4

9.1%

13.2%

16.9%

Dollars in billions and numbers may not sum due to rounding.

Beginning in 1997, detailed asset categories are reported net of specific valuation allowances, loans-in-process,

and unamortized yield adjustments. This reporting change significantly reduced the construction loan balance.

Office of Thrift Supervision / March 2000

10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18