Form D-20cr - Qhtc Corporate Business Tax Credits Page 2

ADVERTISEMENT

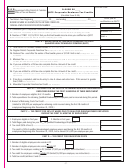

PART E – TAX CREDIT FOR 10% OF WAGES PAID TO QUALIFIED EMPLOYEES DURING

THE FIRST 24 MONTHS OF EMPLOYMENT

1.

Number of

eligible

employees

2.

Total Wages paid during this period to Qualified Employees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

3.

Tax credit – Line 2 x 0.10 (Limited to $5,000 per employee in the tax year.) . . . . . . . . . . . . . . . . . . . . $

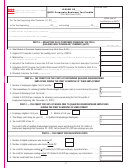

PART F – SUMMARY OF TAX BENEFITS FOR A CORPORATE QHTC

1.

Regular DC Corporate Franchise Tax (Part A, Line 2)

. . . . . .

. . . . . .

. . . . . . . . . . . . . . . . . . . . . . . .

$

2.

Tax Credit (Part A, Line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 6

$

3. Retraining Costs Tax Credit (Part B, Line 3) plus any carryover . . . . . . . . . . . . . . .

$

4. Qualified Disadvantaged Employee Wages Tax Credit (Part C, Line 4

$

plus any carryover . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

5. Relocation Costs Tax Credit (Part D, Line 5) plus any carryover . . . . . . . . . . . . . . .

$

6. Qualified Employee Wages Tax Credit (Part E, Line 3) plus any carryover . . . . . . . . .

7. Total Tax Credits (add Lines 2 through 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

8. Net Tax (Line 1 minus Line 7) If Line 7 is greater than Line 1 enter zero . . . . . . . . . . . . . . . . . . . . . . . . .

$

9. Unused Business QHTC Tax Credit Carryover from this year to 20_____ (Line 7 minus line 1)

(If Line 1 is greater than Line 7 enter 0) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

10. Used Business QHTC Tax Credit

(Line 7 minus Line 9) If Line 7 is greater than zero enter here and on Schedule UB, Line 2 . . . . . . . . . . . . . $

PART G – ELECTION TO RECEIVE 50% REFUND FOR QHTC RETRAINING COSTS CREDIT

1. Amount of Unused Business QHTC Tax Credit Carryover to 20____ (Part F, Line 9) . . . . . . . . . . . . . . . $

2. Retraining Costs Tax Credit (Part B, Line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

3. Unused Business Tax Credit Carryover (Line 1 minus Line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

4. Amount from Line 1 or Line 2, whichever is smaller . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

5. Amount of Retraining Costs Tax Credit to be refunded (50% of Line 4)

enter here and on Schedule UB, Line 7 . . . . . . . . . . . . . . . . . . . . . . . . .

$

-8-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3