Form D-20cr - Qhtc Corporate Business Tax Credits Page 3

ADVERTISEMENT

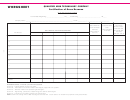

WORKSHEET

QUALIFIED HIGH TECHNOLOGY COMPANY

Certification of Gross Revenue

(To be filed with Form D-20CR)

For Tax Year Beginning: _____________________, 20____ and Ending ___________________________

20____

Company Name: _______________________________________________________________ FEIN: ____________ - _____________________________

Column 5

Column 1

Column 2

Column 3

Column 4

Total

Gross

Gross Revenue

Gross Revenue

Revenue from

from Permitted

from

Permitted and

Activities

Non-Permitted

Non-Permitted

Gross Revenue from Permitted Activities

(add column 2

Activities

Activities

DC Address

A

B

C

D

E

A thru E)

(add cols. 3 & 4)

1.

2.

3.

4.

5.

6.

7.

8.

9.

TOTAL

Permitted Activities - DC Code § 47-1817.01(5)(A)(iii)

Column A – Internet related services and sales.

Column B – Information and communication technologies, equipment and systems.

Column C – Advance material and processing technologies.

Column D – Engineering, production, biotechnology and defense technologies.

Column E – Electronic and photonic devices and components.

NOTE: Columns A through E must not include gross revenue from a retail store or an electronic equipment facility (Data Hotel).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3