Telefile Tax Record And Instructions - Georgia Department Of Revenue - 2000 Page 4

ADVERTISEMENT

Georgia TeleFile Line-by-Line Instructions...

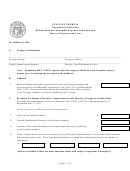

Direct Deposit of Refund - You can choose to have your refund deposited directly into your bank or other

A

financial institution. If the direct deposit information is not correct, the direct deposit request is rejected and a

check is issued. If you have direct deposit on your Federal return, you do not have to complete Line A. Your

State refund will be automatically direct deposited.

Routing Number - The routing number must contain nine digits and begin with the numbers

01 through 12 or 21 through 32.

Account Number – The account number can contain up to 17 numeric characters. Hyphens,

spaces, and special characters should be omitted. Leave any unused boxes blank.

Routing

Account

Robert Johnson

Number

Number

1234

Debra Johnson

123 Main Street

SAMPLE

Anyplace, GA 00000

$

SAMPLE

ANYPLACE BANK

Anyplace, GA 00000

For

:

:

120120012

2120268620

Note:

The Routing and Account numbers may appear in different places on your check.

Lines B through E - Do not complete these lines before calling. During the call, TeleFile will compute these

b

line items and tell you what amounts to write on Lines B through E. The phone number is on the Federal

TeleFile Tax Record that you received from the IRS. (Be sure to complete the top half of your Federal TeleFile Tax

E

Record before calling.)

Contributions- Do not complete these lines before calling. During the call, TeleFile will tell you where to

F

enter the amounts you wish to contribute and tell you what amounts to write on Lines F-1 through 3.

The phone number is on the Federal TeleFile Tax Record that you received from the IRS. (Make sure you com-

plete the top half of your Federal tax record before calling.)

Amount of Your Refund - TeleFile computes and tells you the amount of your refund, if any. Your refund

G

will be mailed to you at the address on your Federal tax record, or you can have it directly deposited into

your bank or other financial institution.

Amount You Owe - TeleFile computes and tells you the amount you owe, if any. Mail your payment using a

H

check or money order along with the payment voucher you clip from page 11. You must remit the balance due

by April 16, 2001 in order to avoid interest and late payment penalties. Be sure to write your social security

number and “Georgia Income Tax 2000 TeleFile” on your check or money order before mailing.

Confirmation Number - Stay on the telephone until you get your TeleFile Confirmation Number. This number

0

confirms you filed your return. If you hang up before you receive the confirmation number or if TeleFile tells you

that you cannot file by phone, you must file a paper return. You can obtain a

Form 500EZ and instructions by calling 404-656-4293 or by downloading the form from our website at

Additional addresses and phone numbers where you can obtain forms

and information are listed on page 9 of this booklet .

Keep the Form 500-T for your tax records

B

Do Not Mail!

-4-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12